ATM: For the Government, the interest rates it charges are moderate

Amid the debate on tax pressure and complaints from the business sector, the local government clarified that the rates are moderate. What happens with the interest in ARCA

Tax pressure in Mendoza and throughout the country is often a point of debate as well as a request from the different private sectors. With national campaign promises to reduce taxes and cut state expenses, during the transition this does not seem to be a simple point for either the Province or the Nation. In this context, while businessmen assure that provincial rates and taxes are high in Mendoza , the Government pointed out that this is governed by a law.

This regulation specifies that the interest rate cannot be lower than the inflation rate, so every month it is adjusted based on the rise in consumer prices of the previous month. “These are not high rates compared to those on the market,” stressed the Minister of Finance, Víctor Fayad , who emphasized the existence of a provincial law that stipulates the value of the rates. He added that with regard to payment plans, the current rate is 2% per month, while the compensatory interest rate is applied every two weeks and was set at 2.60% per month. Meanwhile, for those who are in arrears, there is a penalty that involves paying a monthly rate of 5.60%.

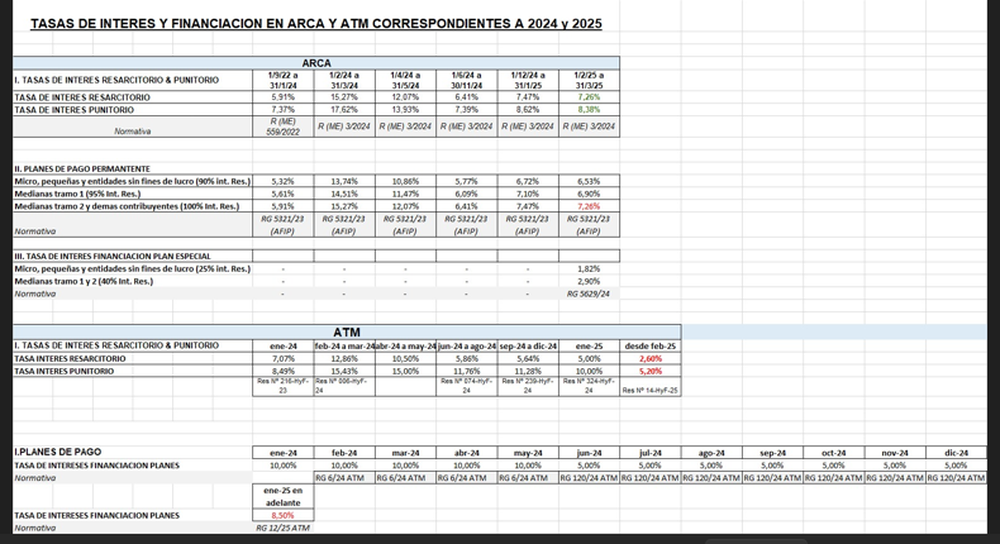

In this context, accountant Mario Comellas, tax specialist, university professor and tax advisor for the Mesa de la Producción y el Empleo, said that Mendoza's rate has historically been below that of the former AFIP and now ARCA. These are the compensatory and punitive interest rates that in ATM are the aforementioned 2.60% and 5.60% for February, respectively. This rate in ARCA is 7.28% and 8.38% for the same categories in said period. However, at the national level there is a differentiation for payment plans for large and small companies, something that - according to Comellas - the province does not have. "ARCA punishes more those who have a greater capacity to pay, while ATM gives the same rate to everyone equally," explained the specialist.

On the other hand, with respect to permanent payment plans (those obtained to regularize a debt), in Mendoza the rates are higher than in the Nation since for February 2025 they are 8.50%. For the period from January to March 2025, the rate of ARCA payment plans was set at 7.26% on average. Along these lines, Comellas explained that ARCA has launched this year a special financing plan so that micro, small and medium-sized companies can regularize their situation. At this time, there is a proposal in force for 120 days with rates of 1.82% for the former and 2.90% for the latter.

image.png

On the other hand, in Mendoza there has not been any moratorium or exemption of fines since 2019, as has happened at the national level, regardless of the colour of the Government, since there was one with Alberto Fernández and another with Javier Milei. “We are not indifferent to those who pay and those who do not, we cannot punish those who are up to date and that is why the punitive rates are higher,” Fayad observed.

A report by Ieral of the Fundación Mediterránea, stated that in Argentina it is said that the legal pressure is very high while it is in the middle of a ranking of effective pressure. “A striking point is that until 2011, the tax pressure (measured as a % of its GDP) in Mendoza was similar to the average of the group of provinces, but in 2012/13 it increased abruptly with the strong increase in rates on Gross Income,” the report highlighted. It added that since 2017 a reduction in some of these rates has begun, but they have not yet reached pre-tax levels.

In this sense, the value of the Gross Income rate remained at the same percentage as in 2024. Minister Víctor Fayad warned that this tax depends on billing and that it cannot be measured based on past or future inflation but rather has to do with activity. For Comellas, one of the problems with Gross Income in Mendoza is the existence of the incremental rate. From his point of view, it should not exist since it is a regressive tax instead of a progressive one like Income Tax. “From billing of 350 million pesos, the incremental rate is paid, which is unfair,” stressed the tax specialist. This is because billing does not necessarily imply profit and everyone should pay the same rate and, in any case, pay the corresponding tax based on what is earned.

The provincial Finance Minister understood the claims of businessmen who are asking for tax cuts, but recalled that there has been a moderation in rates for several years. On the other hand, he added that first it is key to reduce spending and that the province is working hard in this regard with fiscal surpluses in the last years of Government. Regarding the increase in automobile and property taxes, Fayad assured that they are taxes tied to the value of cars and homes that have increased in the last year. “Property taxes look back and cannot be based on projected inflation,” Fayad assured.

- Topics

- Taxes

- Mendoza

- Tax Pressure

losandes