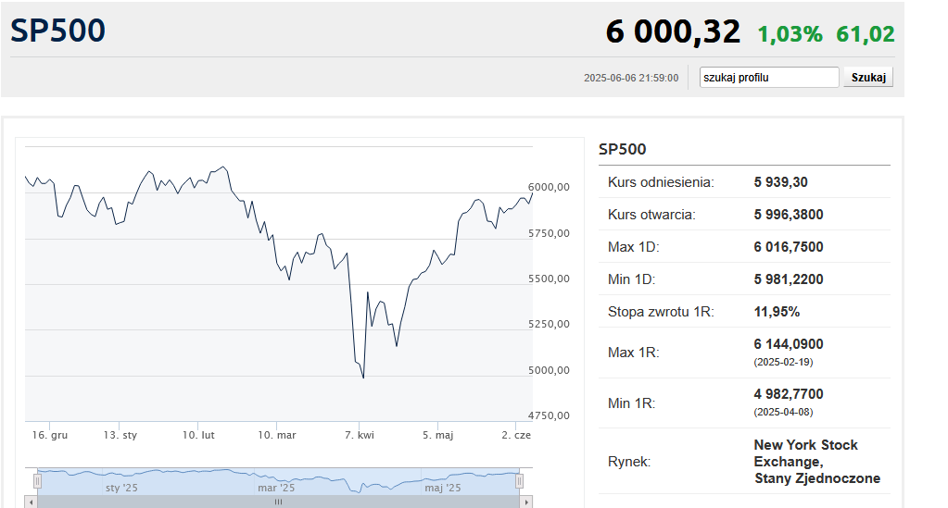

Wall Street up on jobs data. S&P500 hits 6,000 points.

The very ambiguous data from the labor market did not prevent New York Stock Exchanges in recovering their losses and getting close to February levels again bull market peaks. The S&P500 index reached 6,000 for the first time since February 21 points.

S&P500 ended the first week of June at 6000.36 points, up 1.03%. To February's all-time high Only 2.4% left. And that can be done in one session. Nasdaq rose 1.2% to 19,529.95 points. Dow Jones having gained 1.05% he finished with a score of 42,762.87 points.

As usual, on the first Friday of the month, Wall Street counted data from the American labor market appeared . These were only seemingly "good." Yes, the headline number of new jobs in non-agricultural sectors slightly exceeded the market consensus (139k vs. expected 130k), but revisions in the previous two months they cut as many as 95,000 positions.

Moreover, the survey data were disturbing, as it is true that the rate unemployment remained at a relatively low level of 4.2%, but the number the number of employed dropped by almost 700 thousand, while the number of economically inactive people increased by 813 thousand than in April. It doesn't look good. And even in official Payroll statistics show a sharp slowdown in job creation.

The second "trick" used by the stock market bulls was information that a meeting of the government delegation will be held in London on June 9 USA with representatives of the People's Republic of China. It is not really clear why this particular the meeting would bring some breakthrough in the trade war between the two the world's largest economies, but investors took it at face value.

Some analysts, however, point out that the May market data work combined with the acceleration of wage dynamics does not provide much argument Federal Reserve to lower interest rates. Quite the opposite. Powell and company may conclude that despite relatively high real interest rates percentage points in the US the economy is doing well. Or at least that much It is good that it does not generate an increase in unemployment.

- We expect the Fed to leave the policy unchanged at its June meeting. rates unchanged and we believe that data is needed to show a deterioration the condition of the labor market for the Fed to continue the cut cycle - to such a conclusion Goldman Sachs Asset analysts arrived Management. In their opinion, September is the earliest possible date for reduction the federal funds rate, which will be followed by just one more cut in December.

KK

bankier.pl