Interest rates, dollar sales boost RBI income by 27%

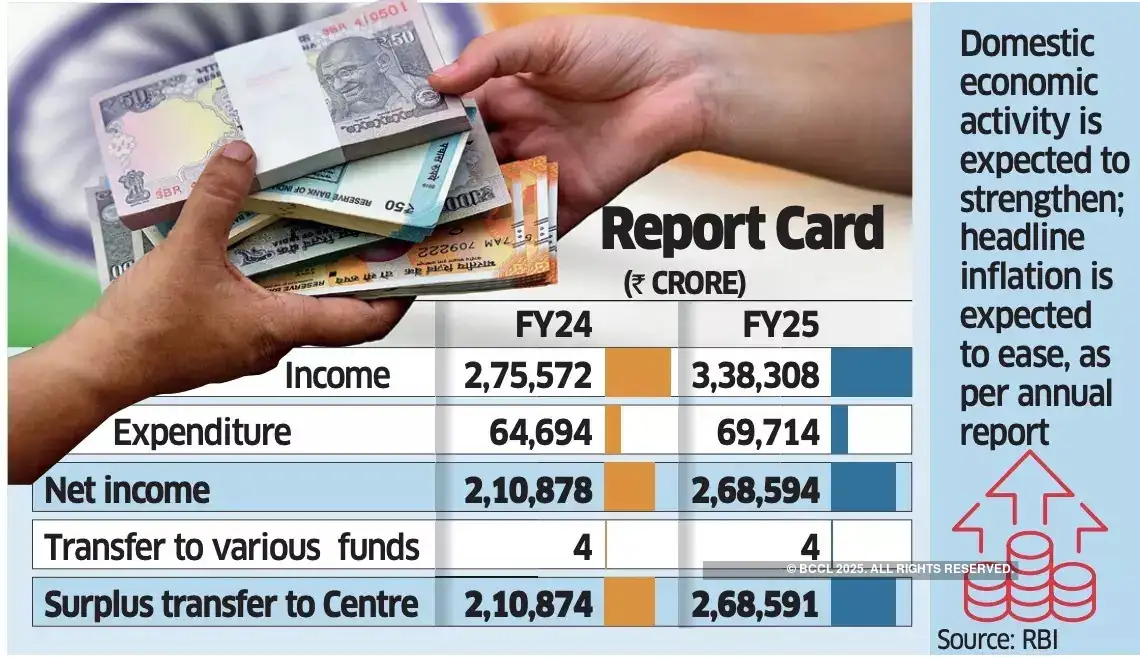

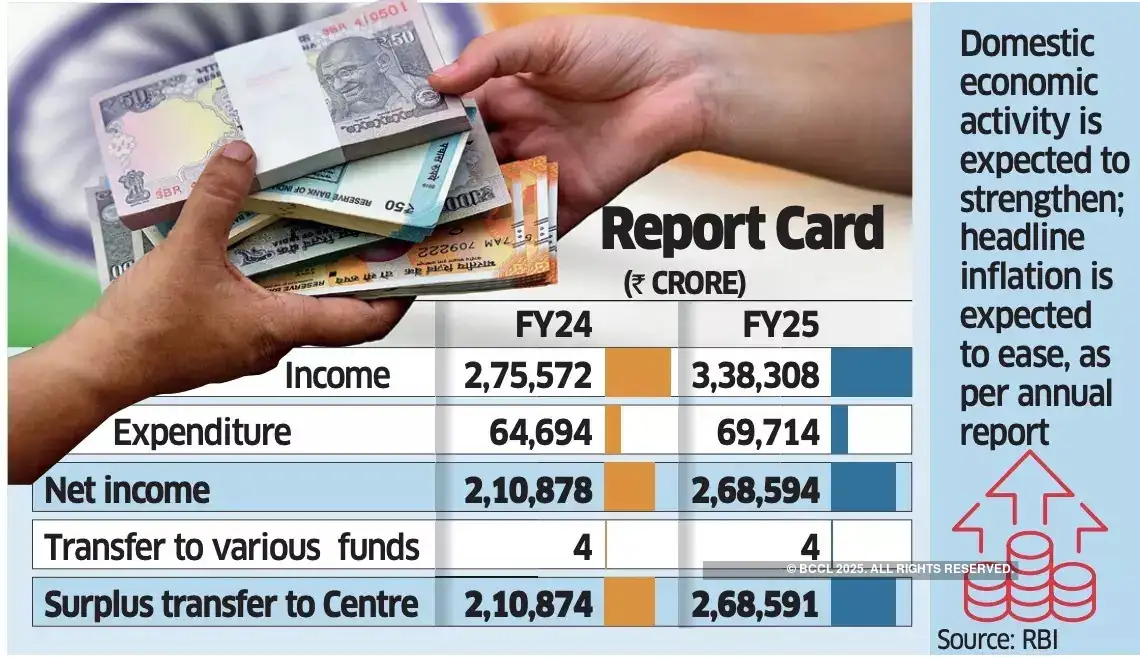

A surge in global interest rates and gains from dollar sales to stem the rupee’s fall boosted the Reserve Bank of India’s (RBI’s) FY25 net income by 27%, enabling it to transfer a record surplus to the central government and help bridge the fiscal gap. North Block’s money manager also demonstrated the prudence it expects from mainstream lenders, boosting gold holdings in its overall asset mix to mitigate quality slippage risks. The central bank’s net income rose to ₹2.69 lakh crore last fiscal, up from ₹2.11 lakh crore a year earlier, as its investments in overseas assets yielded decade-high returns, its annual report shows. “Income from foreign sources increased 38% to ₹2.58 lakh crore,’’ the annual report said. “The rate of earnings on foreign currency assets was 5.31% during the year compared with 4.21%’’ in the year before that. Income from Forex Transactions Up 33% A sharp increase in the returns from foreign currency assets (FCA) of the central bank helped it last week pay a dividend of ₹2.69 lakh crore to the government, up from ₹2.1 lakh crore a year ago, giving the Centre a fiscal space of 0.12% of GDP. The payout was higher despite an increase in the contingency risk buffer (CRB) to a maximum 7.5% of the RBI’s balance sheet under a revised economic capital framework (ECF). “Earnings on FCA improved significantly on account of better returns on the dollar,’’ said Dipanwita Mazumdar, economist at Bank of Baroda. “This becomes critical given that our forex reserves held by the RBI have been increasing and are being invested in various avenues.’’ Interest income from investments in foreign securities was up 48% to ₹97,007 crore against ₹65,328 crore in FY24. The report also says that RBI’s income from foreign exchange transactions rose 33% to ₹1.11 lakh crore in FY25, against ₹83,616 crore a year ago. “This ensures that the Centre meets its fiscal deficit target of 4.4% of GDP—if not exceed,” said Gaura Sengupta, chief economist, IDFC Bank. In FY19, the RBI adopted the ECF that required the central bank to maintain a contingency risk buffer of 5.5–6.5%. “The dividend would have been even higher if the provisioning wasn’t increased to 7.5% of total assets from 6.5% earlier,” said Sengupta. “Indeed, if the provisioning was maintained according to the old framework, the dividend would have been ₹3.5 lakh crore.” Under the revised ECF, the CRB is 4.5–7.5% of the central bank’s balance sheet. “The dividend announcement, though lower than market expectation, was still larger than the budgeted estimate by 0.15% of GDP,’’ said Anubhuti Sahay, Head of India Economics Research, Standard Chartered Bank. Price Stability, Liquidity Going forward, domestic economic activity is expected to strengthen from the lows of the first half of FY25, said the annual report. The economic outlook is an important deciding factor in arriving at the CRB levels. Headline inflation is expected to ease and move further toward the legally mandated target in 2025–26, said the annual report. Monetary policy is committed toward achieving durable price stability, which is a necessary prerequisite for high growth on a sustained basis, said the report. The Reserve Bank will undertake liquidity management operations in sync with the monetary policy stance and keep system liquidity adequate to meet the needs of the productive sectors of the economy, said the annual report. In FY25, the RBI's total expenditure rose 7.76% to ₹69,714 crore, due to higher interest spends, printing of notes and employee costs. The expenditure also includes provisions toward the contingency fund and asset development fund (ADF). However, no provision was made toward ADF. An amount of ₹44,861.70 crore was provided toward the contingency fund to maintain the Available Realised Equity at the level of 7.5% of the balance sheet. Accordingly, the balance in CF as on March 31, 2025, was ₹5.42 lakh crore, compared with ₹4.29 lakh crore as on March 31, 2024. The size of the balance sheet increased by ₹5.78 lakh crore, or 8.2%, to ₹76.25 lakh crore. The increase on the assets side was due to a rise in gold holdings, domestic investments and foreign investments by 52%, 14.3% and 1.7%, respectively. On the liabilities side, expansion was due to an increase in notes issued, revaluation accounts, and other liabilities by 6.03%, 17.32% and 23.31%, respectively. Domestic assets constituted 25.73% while foreign currency assets, gold (including gold deposit and gold held in India) and loans and advances to financial institutions outside India constituted 74.27% of total assets as on March 31, 2025, against 23.31% and 76.69%, respectively, as on March 31, 2024. The share of gold in net foreign assets increased to 12% as at end-March 2025 from 8.3% as at end-March 2024, mainly due to revaluation gains from gold prices. Net credit to the government expanded during the year owing to the liquidity injection through purchase of G-secs via open market operations during January–March 2025.

Interest income from investments in foreign securities was up 48% to ₹97,007 crore against ₹65,328 crore in FY24. The report also says that RBI’s income from foreign exchange transactions rose 33% to ₹1.11 lakh crore in FY25, against ₹83,616 crore a year ago. “This ensures that the Centre meets its fiscal deficit target of 4.4% of GDP—if not exceed,” said Gaura Sengupta, chief economist, IDFC Bank. In FY19, the RBI adopted the ECF that required the central bank to maintain a contingency risk buffer of 5.5–6.5%. “The dividend would have been even higher if the provisioning wasn’t increased to 7.5% of total assets from 6.5% earlier,” said Sengupta. “Indeed, if the provisioning was maintained according to the old framework, the dividend would have been ₹3.5 lakh crore.” Under the revised ECF, the CRB is 4.5–7.5% of the central bank’s balance sheet. “The dividend announcement, though lower than market expectation, was still larger than the budgeted estimate by 0.15% of GDP,’’ said Anubhuti Sahay, Head of India Economics Research, Standard Chartered Bank. Price Stability, Liquidity Going forward, domestic economic activity is expected to strengthen from the lows of the first half of FY25, said the annual report. The economic outlook is an important deciding factor in arriving at the CRB levels. Headline inflation is expected to ease and move further toward the legally mandated target in 2025–26, said the annual report. Monetary policy is committed toward achieving durable price stability, which is a necessary prerequisite for high growth on a sustained basis, said the report. The Reserve Bank will undertake liquidity management operations in sync with the monetary policy stance and keep system liquidity adequate to meet the needs of the productive sectors of the economy, said the annual report. In FY25, the RBI's total expenditure rose 7.76% to ₹69,714 crore, due to higher interest spends, printing of notes and employee costs. The expenditure also includes provisions toward the contingency fund and asset development fund (ADF). However, no provision was made toward ADF. An amount of ₹44,861.70 crore was provided toward the contingency fund to maintain the Available Realised Equity at the level of 7.5% of the balance sheet. Accordingly, the balance in CF as on March 31, 2025, was ₹5.42 lakh crore, compared with ₹4.29 lakh crore as on March 31, 2024. The size of the balance sheet increased by ₹5.78 lakh crore, or 8.2%, to ₹76.25 lakh crore. The increase on the assets side was due to a rise in gold holdings, domestic investments and foreign investments by 52%, 14.3% and 1.7%, respectively. On the liabilities side, expansion was due to an increase in notes issued, revaluation accounts, and other liabilities by 6.03%, 17.32% and 23.31%, respectively. Domestic assets constituted 25.73% while foreign currency assets, gold (including gold deposit and gold held in India) and loans and advances to financial institutions outside India constituted 74.27% of total assets as on March 31, 2025, against 23.31% and 76.69%, respectively, as on March 31, 2024. The share of gold in net foreign assets increased to 12% as at end-March 2025 from 8.3% as at end-March 2024, mainly due to revaluation gains from gold prices. Net credit to the government expanded during the year owing to the liquidity injection through purchase of G-secs via open market operations during January–March 2025.

Interest income from investments in foreign securities was up 48% to ₹97,007 crore against ₹65,328 crore in FY24. The report also says that RBI’s income from foreign exchange transactions rose 33% to ₹1.11 lakh crore in FY25, against ₹83,616 crore a year ago. “This ensures that the Centre meets its fiscal deficit target of 4.4% of GDP—if not exceed,” said Gaura Sengupta, chief economist, IDFC Bank. In FY19, the RBI adopted the ECF that required the central bank to maintain a contingency risk buffer of 5.5–6.5%. “The dividend would have been even higher if the provisioning wasn’t increased to 7.5% of total assets from 6.5% earlier,” said Sengupta. “Indeed, if the provisioning was maintained according to the old framework, the dividend would have been ₹3.5 lakh crore.” Under the revised ECF, the CRB is 4.5–7.5% of the central bank’s balance sheet. “The dividend announcement, though lower than market expectation, was still larger than the budgeted estimate by 0.15% of GDP,’’ said Anubhuti Sahay, Head of India Economics Research, Standard Chartered Bank. Price Stability, Liquidity Going forward, domestic economic activity is expected to strengthen from the lows of the first half of FY25, said the annual report. The economic outlook is an important deciding factor in arriving at the CRB levels. Headline inflation is expected to ease and move further toward the legally mandated target in 2025–26, said the annual report. Monetary policy is committed toward achieving durable price stability, which is a necessary prerequisite for high growth on a sustained basis, said the report. The Reserve Bank will undertake liquidity management operations in sync with the monetary policy stance and keep system liquidity adequate to meet the needs of the productive sectors of the economy, said the annual report. In FY25, the RBI's total expenditure rose 7.76% to ₹69,714 crore, due to higher interest spends, printing of notes and employee costs. The expenditure also includes provisions toward the contingency fund and asset development fund (ADF). However, no provision was made toward ADF. An amount of ₹44,861.70 crore was provided toward the contingency fund to maintain the Available Realised Equity at the level of 7.5% of the balance sheet. Accordingly, the balance in CF as on March 31, 2025, was ₹5.42 lakh crore, compared with ₹4.29 lakh crore as on March 31, 2024. The size of the balance sheet increased by ₹5.78 lakh crore, or 8.2%, to ₹76.25 lakh crore. The increase on the assets side was due to a rise in gold holdings, domestic investments and foreign investments by 52%, 14.3% and 1.7%, respectively. On the liabilities side, expansion was due to an increase in notes issued, revaluation accounts, and other liabilities by 6.03%, 17.32% and 23.31%, respectively. Domestic assets constituted 25.73% while foreign currency assets, gold (including gold deposit and gold held in India) and loans and advances to financial institutions outside India constituted 74.27% of total assets as on March 31, 2025, against 23.31% and 76.69%, respectively, as on March 31, 2024. The share of gold in net foreign assets increased to 12% as at end-March 2025 from 8.3% as at end-March 2024, mainly due to revaluation gains from gold prices. Net credit to the government expanded during the year owing to the liquidity injection through purchase of G-secs via open market operations during January–March 2025.

Interest income from investments in foreign securities was up 48% to ₹97,007 crore against ₹65,328 crore in FY24. The report also says that RBI’s income from foreign exchange transactions rose 33% to ₹1.11 lakh crore in FY25, against ₹83,616 crore a year ago. “This ensures that the Centre meets its fiscal deficit target of 4.4% of GDP—if not exceed,” said Gaura Sengupta, chief economist, IDFC Bank. In FY19, the RBI adopted the ECF that required the central bank to maintain a contingency risk buffer of 5.5–6.5%. “The dividend would have been even higher if the provisioning wasn’t increased to 7.5% of total assets from 6.5% earlier,” said Sengupta. “Indeed, if the provisioning was maintained according to the old framework, the dividend would have been ₹3.5 lakh crore.” Under the revised ECF, the CRB is 4.5–7.5% of the central bank’s balance sheet. “The dividend announcement, though lower than market expectation, was still larger than the budgeted estimate by 0.15% of GDP,’’ said Anubhuti Sahay, Head of India Economics Research, Standard Chartered Bank. Price Stability, Liquidity Going forward, domestic economic activity is expected to strengthen from the lows of the first half of FY25, said the annual report. The economic outlook is an important deciding factor in arriving at the CRB levels. Headline inflation is expected to ease and move further toward the legally mandated target in 2025–26, said the annual report. Monetary policy is committed toward achieving durable price stability, which is a necessary prerequisite for high growth on a sustained basis, said the report. The Reserve Bank will undertake liquidity management operations in sync with the monetary policy stance and keep system liquidity adequate to meet the needs of the productive sectors of the economy, said the annual report. In FY25, the RBI's total expenditure rose 7.76% to ₹69,714 crore, due to higher interest spends, printing of notes and employee costs. The expenditure also includes provisions toward the contingency fund and asset development fund (ADF). However, no provision was made toward ADF. An amount of ₹44,861.70 crore was provided toward the contingency fund to maintain the Available Realised Equity at the level of 7.5% of the balance sheet. Accordingly, the balance in CF as on March 31, 2025, was ₹5.42 lakh crore, compared with ₹4.29 lakh crore as on March 31, 2024. The size of the balance sheet increased by ₹5.78 lakh crore, or 8.2%, to ₹76.25 lakh crore. The increase on the assets side was due to a rise in gold holdings, domestic investments and foreign investments by 52%, 14.3% and 1.7%, respectively. On the liabilities side, expansion was due to an increase in notes issued, revaluation accounts, and other liabilities by 6.03%, 17.32% and 23.31%, respectively. Domestic assets constituted 25.73% while foreign currency assets, gold (including gold deposit and gold held in India) and loans and advances to financial institutions outside India constituted 74.27% of total assets as on March 31, 2025, against 23.31% and 76.69%, respectively, as on March 31, 2024. The share of gold in net foreign assets increased to 12% as at end-March 2025 from 8.3% as at end-March 2024, mainly due to revaluation gains from gold prices. Net credit to the government expanded during the year owing to the liquidity injection through purchase of G-secs via open market operations during January–March 2025.economictimes