Analysis by HQ Trust: Small caps back in focus – why small caps are now becoming interesting

Tech giants have dominated stock market news for months. Smaller companies, on the other hand, are living a shadowy existence – and this is reflected in their valuations. The traditionally higher price that investors had to accept for small caps hardly exists anymore. Pascal Kielkopf, capital markets analyst at the multi-family office HQ Trust, investigated why this is the case.

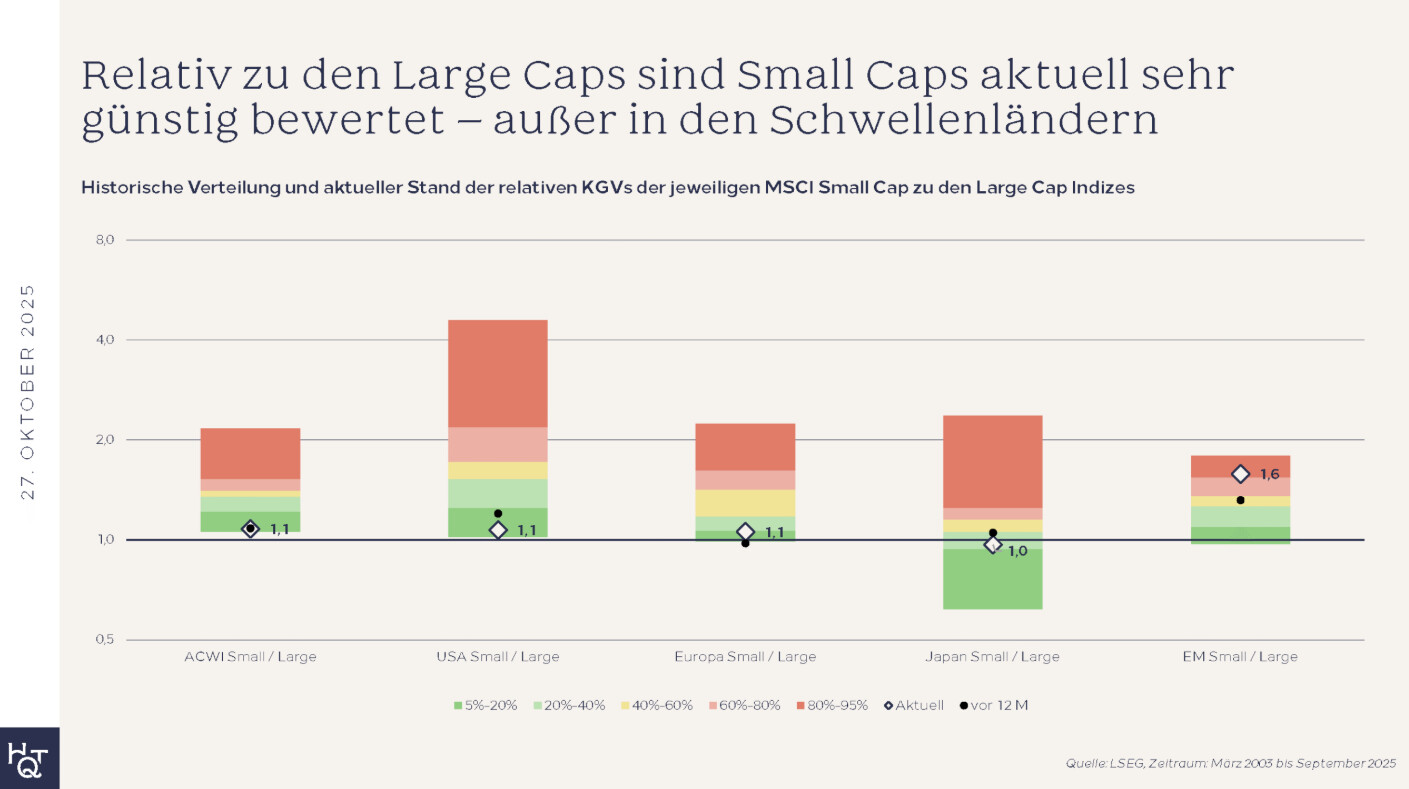

Kielkopf analyzed how the valuation levels of small caps compare to those of large caps – measured by the price-earnings ratios (P/E) of the respective MSCI indices. To do this, he compares the P/E ratios of the small-cap benchmarks to their large-cap counterparts.

A current example: The MSCI ACWI global equity index currently has a P/E ratio of 23.2, while the MSCI ACWI Small Cap index is at 25.0. Small caps are thus valued around 10 percent higher, corresponding to a relative ratio of 1.1.

Higher valuations for smaller companies are no coincidence: they generally grow faster, can respond more flexibly to market changes, and are more likely to attract the interest of potential buyers.

Companies like Apple and Nvidia were once little-known startups before rising to global market leaders through innovation and economies of scale. This opportunity to be invested in future success stories from the very beginning makes many investors willing to pay a premium.

Tech dominance and interest rate turnaround weigh on small capsCurrently, however, the picture is different: "Compared to large caps, small-cap stocks are currently very cheap," explains Kielkopf. In addition to small stocks from Europe and Japan, US small caps are also cheap compared to large corporations. In all three regions, the valuation premium is currently very small.

The reason for this development lies in recent years. "Driven by tech dominance and the ability to better cope with rising interest rates, large caps have been able to outperform in recent years, thereby narrowing the valuation premium," says the capital market analyst.

Emerging markets as an exceptionOnly the emerging markets are out of step: According to experts, large companies there have had a difficult time in recent years due to increasing regulation and government intervention: "Smaller companies, which often cover local consumer and niche businesses, were significantly less burdened by these factors."

Accordingly, the valuation premium in emerging markets has recently even widened: "The ratio here is 1.6. Small caps are therefore valued significantly more expensively than large caps."

Patience and active management requiredWhat does the current situation mean for investors? Christian Subbe, CIO of HQ Trust , explains: "Regardless of valuation, small-cap stocks are always a sensible addition to large caps in a diversified portfolio."

The current discount could be a compelling reason to add small caps to your portfolio – especially for investors who have concerns about the high valuations of large caps. "The relative comparison in itself isn't a short-term buy signal. However, especially for long-term investors, it can be an indication that the market is overlooking opportunities here," says Subbe.

However, past experience shows that investors may need patience. They cannot immediately expect better performance than the broader market.

Subbe also sees good opportunities for active management in this area: "This is especially true in the US, where many small caps are of rather low quality. Here, selecting the right companies is key."

private-banking-magazin