Bitcoin continues to chase records: New all-time high – analysts see $500,000.

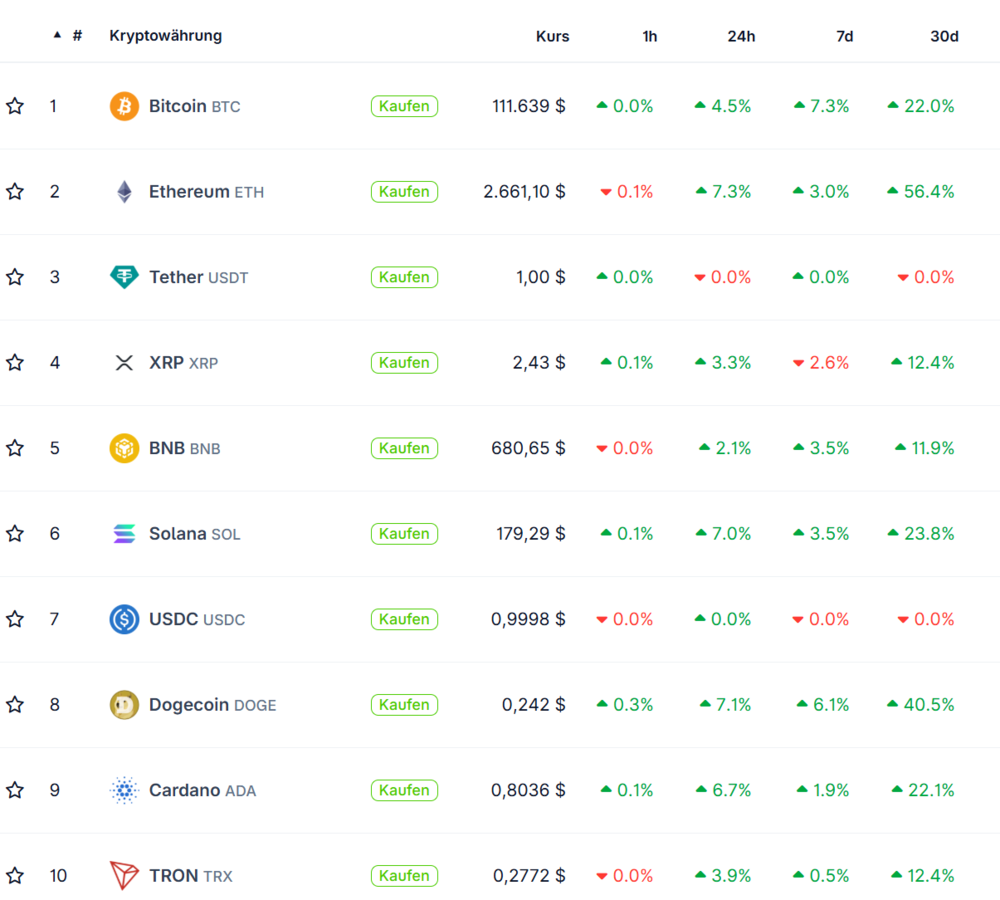

Cryptocurrency prices once again showed their strength on Thursday. Led by Bitcoin, which reached fresh all-time highs, bullish momentum swept across the entire crypto market. Exciting times are ahead for investors—the rally seems far from over.

The world's largest cryptocurrency, Bitcoin, climbed by more than four percent to an impressive $111,980 on trading platforms like Binance in the past 24 hours, before retreating slightly to its current $111,690. Following in the footsteps of the market leader, various altcoins also gained significantly.

The massive price momentum has caused demand for global crypto options to skyrocket. Open interest (OI) for Bitcoin options reached a new all-time high of over $45.8 billion, accounting for nearly 84 percent of the entire digital asset options market, according to CoinGlass data. At the same time, open interest for ETH options surged to over $8 billion. Total open interest for Bitcoin and Ether options thus grew to over $53.8 billion in notional value—the highest level since December 2024.

All drivers at full loadGeoffrey Kendrick, global head of digital asset research at Standard Chartered, sees clear reasons for the current bull run. He explained that the previously known market stimulants combined to fuel the BTC rally. "With Bitcoin reaching a projected all-time high, it's time to take stock and see which of our predicted drivers are working. Short answer – everything is working," Kendrick wrote in a May 22 report.

Earlier this week, Kendrick reiterated his ambitious $500,000 price target for Bitcoin, which he expects to be reached during US President Donald Trump's current term in office. To support his thesis, the Standard Chartered expert cited quarterly 13F data from the US Securities and Exchange Commission (SEC). These data showed that sovereign states and institutions are increasing their exposure to Bitcoin through proxy assets like MicroStrategy. This trend is likely to continue into the second quarter of 2025.

In addition, since gold's peak on April 22, capital has shifted from gold funds to Bitcoin products. Gold ETPs lost over $3.6 billion, while BTC ETFs gained over $7.5 billion during those five weeks, according to Kendrick. Hedge fund short sales increased by only $1 billion during that time, suggesting that net long positions accounted for the lion's share of BTC ETF flows.

Kendrick also emphasized that Bitcoin remains closely correlated with the U.S. Treasury forward premium. Increasing risks in the Treasury market, both domestically and internationally, would further increase Bitcoin's attractiveness. His forecasts are clear: "My official predictions for Bitcoin are $120,000 by the end of Q2, $200,000 by the end of 2025, and $500,000 by the end of 2028. All are well on track," the analyst said.

The Bitcoin Express is rolling relentlessly, and the signs are clearly pointing toward a storm. Institutional interest, the positive sentiment under President Trump, and the impressive price performance speak volumes. Investors are therefore staying on board.

But if you want to get even more out of the current crypto bull market and find out which altcoins are currently hot, you should take a look at the Bitcoin Report. Learn more here.

Note on conflicts of interest The board member and majority shareholder of the publisher Börsenmedien AG, Mr. Bernd Förtsch, has directly and indirectly entered into positions in the following financial instruments or derivatives related to them mentioned in the publication, which may benefit from any price development resulting from the publication: Bitcoin.

Gerd Weger has been successfully active in the markets since the 1980s and is known to many stock market participants as a columnist for €uro am Sonntag and as the operator of his legendary "Millionaire Depot." In 2017, he shifted his focus from stocks to cryptocurrencies and has now published a standard work: The focus is on the valuation factors of Bitcoin and other cryptocurrencies. The book systematically presents fundamental analysis approaches that are completely different from those used for stocks. Also important are considerations for tax optimization. For informed investors and traders, all of this is essential for sustainable investment success with cryptocurrencies.

deraktionaer.de