From regional and private banks: How advisors performed in Bafin's certificate study

A few months ago, BaFin sounded the alarm: After the low-interest-rate phase, sales of certain certificates had increased. Interest and express certificates, in particular, had suddenly become brisk. BaFin's suspicion, based on the high sales figures, was that some advisors may have pressured clients to purchase (overly) complicated certificates.

For the supervisory authority, this is a "topic of significant relevance for consumer protection" – and the starting point of an investigation in which BaFin spent months examining how banks, for example, sold the certificates in their investment advice. BaFin has now presented the detailed results of its study – which also provide insights into how investment advice regarding the certificates is provided. For this purpose, the supervisory authority surveyed, among others, eight savings banks, six cooperative banks, and four private banks, which are among the largest customers of the certificate manufacturers.

Bafin praises banks' investment advisory strategyBaFin gave the institutions examined a positive report. The distributors did not favor investment or deposit products, but instead analyzed the customer's situation – as required by regulation: "Based on this analysis, customers were given a selection of potentially suitable products, which were then explored in more detail with their advisor."

There's a need to catch up with sales margins. Because institutions don't consistently allocate these to product or service costs, investors have a harder time comparing certificates and investment advisory offerings. BaFin also sees a need to catch up with the choice of the right certificate structure: The supervisory authority encourages investment advisors to choose barriers for express certificates that are suitable and understandable for the client – but not in a way that provides an opportunity to reinvest the capital as quickly as possible in the event of early repayment.

Customers are asking for certificates – but understand funds much betterTwo consumer surveys conducted by BaFin suggest that it's not primarily sales companies that place certificates with customers, but rather customers actively request them. In only 43 percent of cases did the initiative come from advisors. However, in isolated cases, customers were advised about certificates even though they intended to purchase deposit products – a shortcoming BaFin considers, and it would like to discuss this with the relevant institutions.

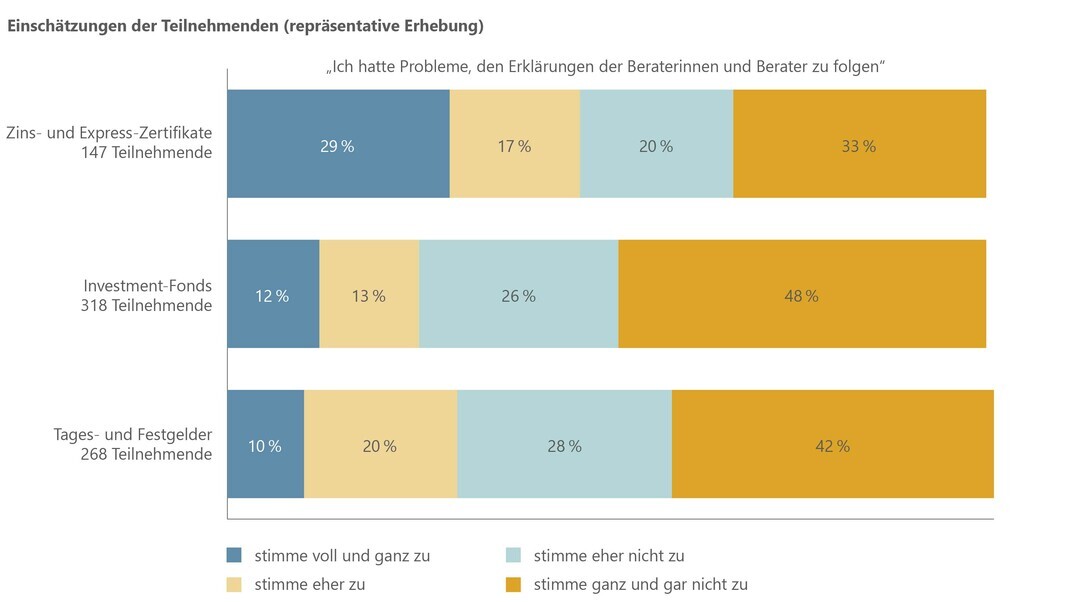

By the way: When advisors talk to their clients about certificates, consumers are more likely to have difficulty understanding them than with investment funds or call and fixed-term deposits. Nevertheless, approximately 90 percent of clients in the representative part of the survey reported that they trust their advisor and that the products they recommend generally meet their expectations.

Even in some test purchases, BaFin did not necessarily determine that savings banks, cooperative banks, or private banks were selling certificates that were unsuitable for their customers. In any case, BaFin intends to take action: "The goal is to enable consumers to fully assess and critically evaluate products and their functionality, and to make well-informed investment decisions."

private-banking-magazin