In the slipstream of Rheinmetall & Co: Real depot value at an all-time high before figures – is there still more to come?

Defense stocks are still in demand. Rheinmetall is one of the strongest stocks in the DAX on Tuesday. Reports of a possible new special fund worth 200 billion euros in Germany are giving momentum. In the slipstream, AKTIONÄR's old recommendation Alzchem can also continue its record run. The background!

Alzchem is growing sustainably and is becoming increasingly profitable. This should be made clear again by the quarterly figures due next Friday (February 28). In addition to lower energy costs and a balanced product portfolio - particularly in the areas of nutrition, agriculture and specialty chemicals - the increase in defense spending is providing additional impetus.

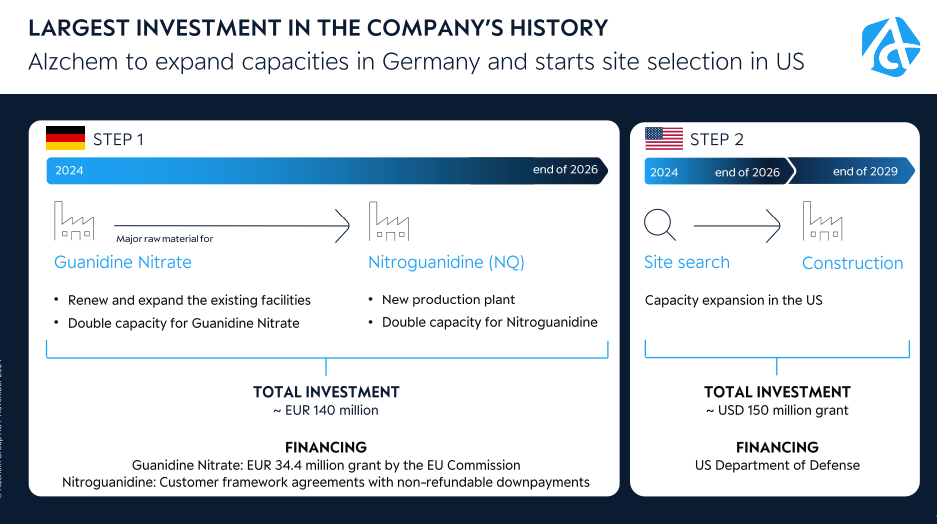

Alzchem says it is the world's only non-Chinese producer of guanidine nitrate, a precursor to nitroguanidine. This is used in the production of crop protection products and as a propellant for gas generators in airbags. Nitroguanidine is also becoming increasingly important in military technology: it is increasingly used as a propellant for artillery shells. Rheinmetall reportedly uses it for so-called high-efficiency ammunition, including 120 mm tank ammunition (Leopard 2) and artillery shells (150 mm) with an increased range.

Demand is high, capacities are already being expanded, and supply contracts with defense customers have been concluded. Concrete figures on the current share of nitroguanidine in the expected total sales in 2024 (570 million euros) are not explicitly stated, but should still (!) be manageable.

However, Alzchem plans to double its production capacity for nitroguanidine by 2026. From 2027, medium to long-term sales are expected to increase in the upper double-digit million range - with correspondingly positive earnings contributions. The share of total sales should therefore increase significantly. A preliminary agreement has even been concluded with the US Department of Defense to finance a possible production facility in the USA.

Thanks to the attractive growth potential, earnings per share of EUR 5.50 (2024e: EUR 5.00) are already possible next year with revenues of EUR 600 million (2024e: EUR 570 million) and an EBITDA margin of 19 percent. The P/E ratio would therefore still be a reasonable 13 even after several months of upward movement. The mix of prospects, dynamics and valuation is right. DER AKTIONÄR is therefore continuing to bet on rising prices in the real portfolio for the time being, even if profit-taking is always an option.

Note on conflicts of interest: Alzchem shares are held in a real depot of Börsenmedien AG.

What works on Wall Street ... ... also works the way Joe Mustermann does. "What Works on Wall Street" is a classic stock market book. It impresses with its rational, empirical approach - and thus takes to heart one of the key pieces of advice that all successful investors follow: keep emotions out of the investment process! Based on data that sometimes goes back a long way, James P. O'Shaughnessy analyzes which investment strategies have proven to be permanently successful, which key figures you should really pay attention to, why trend following works, how you can make growth and value work for you, and much more.

deraktionaer.de