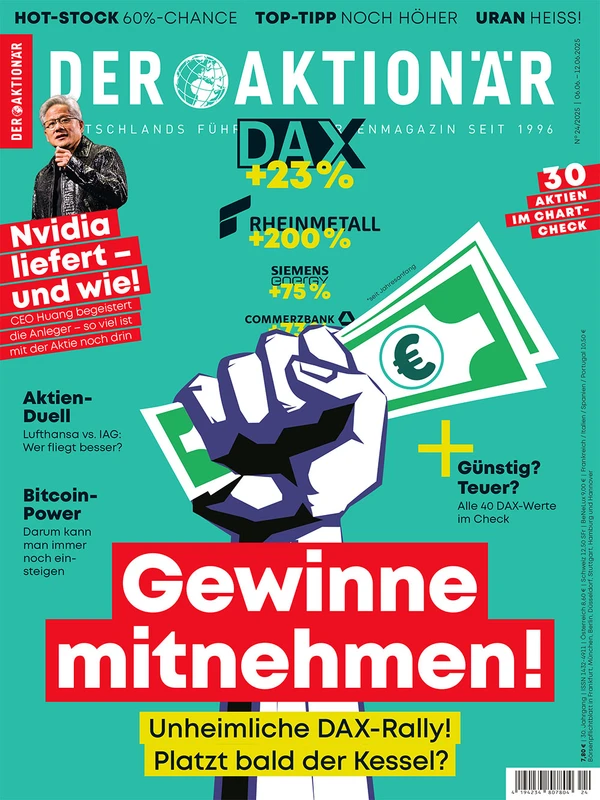

It doesn't always have to be Rheinmetall, Siemens Energy, Commerzbank or Airbus – bet on the favorites now!

Following this year's strong share price performance, there are increasing voices in financial circles that the air is getting thinner for the blue chips in the leading German index DAX. However, the picture is different for small and mid-caps: More and more investors are betting on a sustained comeback for stocks that have been neglected for years.

The good news: Against the backdrop of a revival in demand in many sectors and the attractive valuation of numerous stocks, the recent price increases are likely to have been just the starting signal for a sustained upward trend.

In addition, the German government is working hard to improve the framework conditions for a recovery of the German economy. This should lead to a continued flow of capital into small and mid-caps – including this Real Depot trio.

Join now and be there from the start

Allgeier: The company offers a comprehensive portfolio of IT and software services – from advanced software development to efficiency solutions for companies – with a strong focus on digitalization and business transformation. Around 40 percent of Allgeier's revenue is generated in the public sector, where the company holds a solid market position. Over 80 percent of revenue is generated in Germany. In the first quarter, operational performance was impacted by delays in the implementation of planned digitalization projects in the public sector. However, with increasing digitalization budgets expected, particularly at the federal level, a recovery is expected for the second half of the year. Investors can therefore already get their foot in the door – and bet on a sustainable comeback for the share. DER AKTIONÄR is betting on this scenario in its Real portfolio.

2G Energy: With its combination of combined heat and power (CHP) plants, large-scale heat pumps, and peak-load generators, the company is positioned worldwide as a system provider for decentralized energy solutions. After a largely politically induced growth dip, 2G is aiming to return to growth in the current fiscal year. While sales were still at €51 million in 2009, they reached €376 million by 2024 – a sevenfold increase. The company has been consistently profitable throughout this period. Thanks to its high order backlog, 2G Energy has already largely secured its 2025 target. Further efficiency improvements along the value chain are expected to lead to an EBIT margin.

The company expects tailwind from major orders in the heat pump sector and from the introduction of the so-called demand-response engine in the USA in the second half of 2025. Background: 2G's latest product, a gas engine for use during peak loads, is therefore likely to enjoy particularly high demand in the USA.

Background: "Weak power grids and the rapidly growing power demand of data centers in the age of digitalization and artificial intelligence are creating regional power demand hotspots and an unstable power supply in the USA," says industry expert Karsten von Blumenthal. "This is where an engine that can be deployed in seconds and withstand the highest loads comes in handy," adds 2G CFO Friedrich Pehle. Marketing of the peak-load generator has already gotten off to a successful start. So has the stock. The position in Real's portfolio is up around 30 percent.

Technotrans: The company is performing well so far in the 2025 fiscal year. CEO Michael Finger has consistently expanded its position in focus markets such as liquid cooling for data centers. At the end of 2024, a framework agreement for series production was successfully established with a US customer for the first time.

In addition, the government's planned "billion-euro boost" is likely to provide new impetus for applications in battery cooling for electric buses and trains, as well as products for charging infrastructure, such as cooling for rapid charging stations for e-mobility and converter cooling for the rail network from the Energy Management sector. In short: After several years of uncertainty and forecast adjustments, Technotrans should now, with the measures it has initiated, bring horsepower to the road in a sustainable manner. Real-Depot also entered this market early. The position is already up around 40 percent.

Bet on tomorrow's winners nowWith the Real Depot, investors have a front-row seat to the comeback of domestic small and mid-caps. This trio still has room to grow – both from a technical and fundamental perspective. And: The next potential high-flyer is already waiting in the wings. Want to be there from the start when the next portfolio is opened? Then try the Real Depot NOW for 3 months for just €210.

Note on conflicts of interest: Shares of 2G Energy, Allgeier and Technotrans are held in a real depot of Börsenmedien AG.

In this groundbreaking book, Jonathan McMillan offers a new perspective on our economic system. He shows that capitalism and a market economy are not the same thing, revealing a fundamental flaw in our financial architecture. This has tangible consequences – especially for Europe.

McMillan places the Eurozone's problems in a broader historical context and develops a radical yet well-thought-out reform proposal. It becomes clear that anyone who wants to preserve a free and democratic society in the 21st century cannot avoid a new economic order.

deraktionaer.de