ITM Power: Double blow – share on the verge of a turnaround?

An exception in a badly battered industry: British hydrogen specialist ITM Power was able to impress market participants with several pieces of good news last week. From a technical perspective, the chart picture continues to brighten thanks to the price gains.

First, it was announced last week that ITM Power had been selected for the 120-megawatt Humber H2ub project. The British company will supply six 20-megawatt modules to the client, Uniper, for the project. However, the project is still subject to a final investment decision (FID), which is expected next year. Commissioning is currently planned for 2029. Humber H2ub will be a hydrogen production plant at Uniper's Killingholme site.

One day later, ITM Power announced another order. In Spain, a leading cement manufacturer has opted for the fully autonomous two-megawatt electrolyzer system (NEPTUNE-II). The British company did not disclose financial details. However, ITM Power expects the order to be booked in fiscal year 2026 (fiscal year-end: April 2026).

The good news is giving the share price further momentum. Shortly before the two orders, the company had already secured an order in Germany ( DER AKTIONÄR reported ). In addition, in April the company raised its forecast for the fiscal year ending a few days later.

Electrolysis specialist ITM Power is currently performing impressively both in terms of order intake and operational performance. Technically, the bulls are gradually taking control of the hydrogen stock, which has come under severe pressure. However, the stock is only suitable for speculative investors looking to reposition themselves in the hydrogen sector after a lean period.

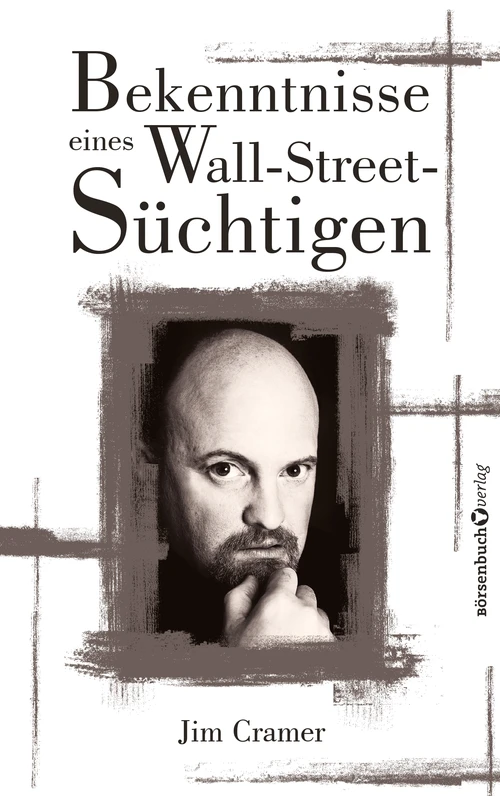

Even as a boy, Jim Cramer was fascinated by the stock market and quickly discovered his knack for making promising trades. He brilliantly recounts how, as a sought-after journalist, he lost everything he owned and yet never gave up. Cramer threw himself wholeheartedly into the stock market, fought his way back, and became a wealthy money manager, constantly driven by the insane pace and immense pressure to outperform the market and other fund managers. Cramer—who knows Wall Street better than anyone—takes the reader on a guided tour where no door remains closed. He reveals how the game is played, who breaks the rules, and who gets the short end of the stick.

deraktionaer.de