M&A study: German market more stable, but recovery fails to materialise

The German small and mid-cap M&A market bottomed out in the second half of 2025, according to experts at Dealcircle. Their analysis is based on a survey in which more than 1,000 M&A advisors, private equity investors, and strategic buyers participated.

Market stabilizes at a low level“Buyers are acting cautiously, while sellers are often holding back their businesses – hoping to achieve better prices in a year.” Kai Hesselmann, Dealcircle

Accordingly, after several quarters of declining transactions and falling multiples, the market is showing sideways movement for the first time. Around 89 percent of respondents expect stable valuations, while only 12 percent anticipate rising prices. Buyers are acting cautiously, while sellers are often holding on to their companies – hoping to achieve better prices in a year's time.

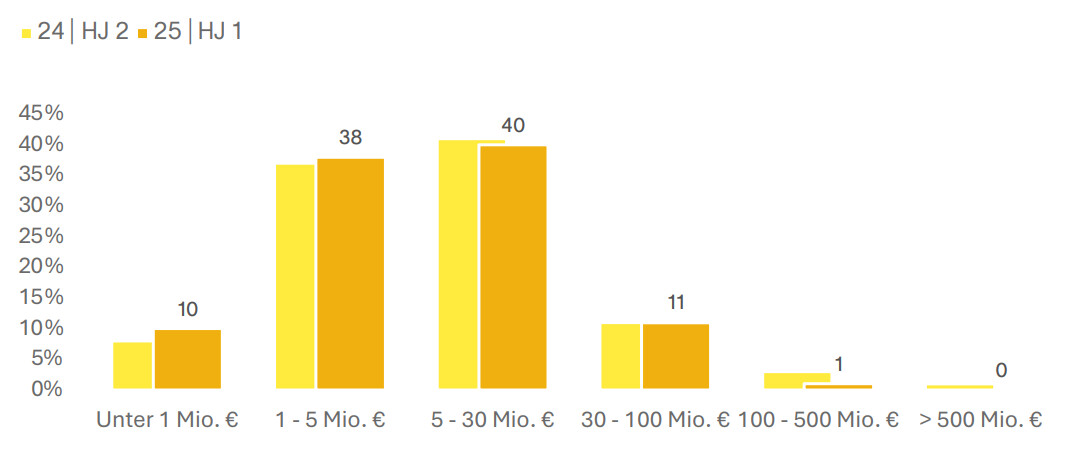

How many transactions were you personally involved in in the first half of 2025?

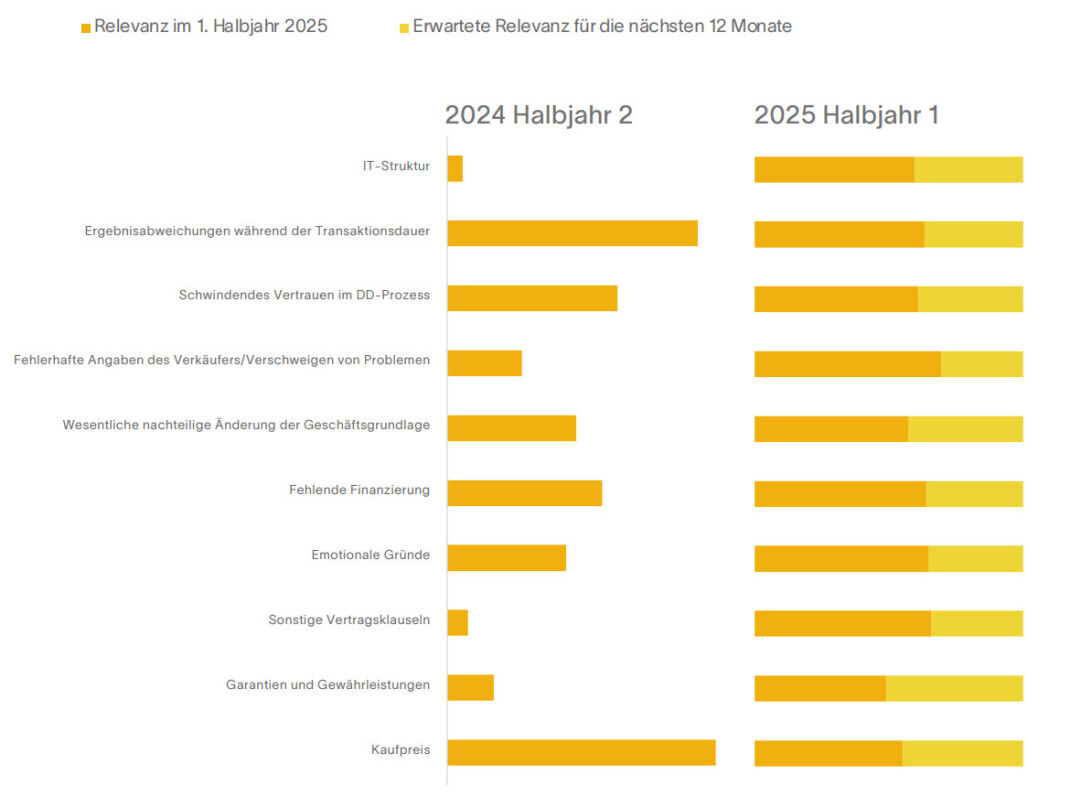

According to the study's authors, numerous transactions end without a conclusion. Excessively high purchase price expectations are the most common reason for termination at 21 percent, followed by declines in ongoing business (20 percent) and loss of confidence in due diligence (14 percent). A lack of financing leads to failure in 12 percent of cases. Dealcircle advises more realism and preparation to avoid jeopardizing transactions.

Business successions continue to dominate the market. In Germany, around 200,000 companies face a transfer each year. However, profitable medium-sized companies in particular are waiting. Active sellers are often owners of average businesses, leading to an oversupply of less attractive targets. For buyers, this means more choice, but lower quality.

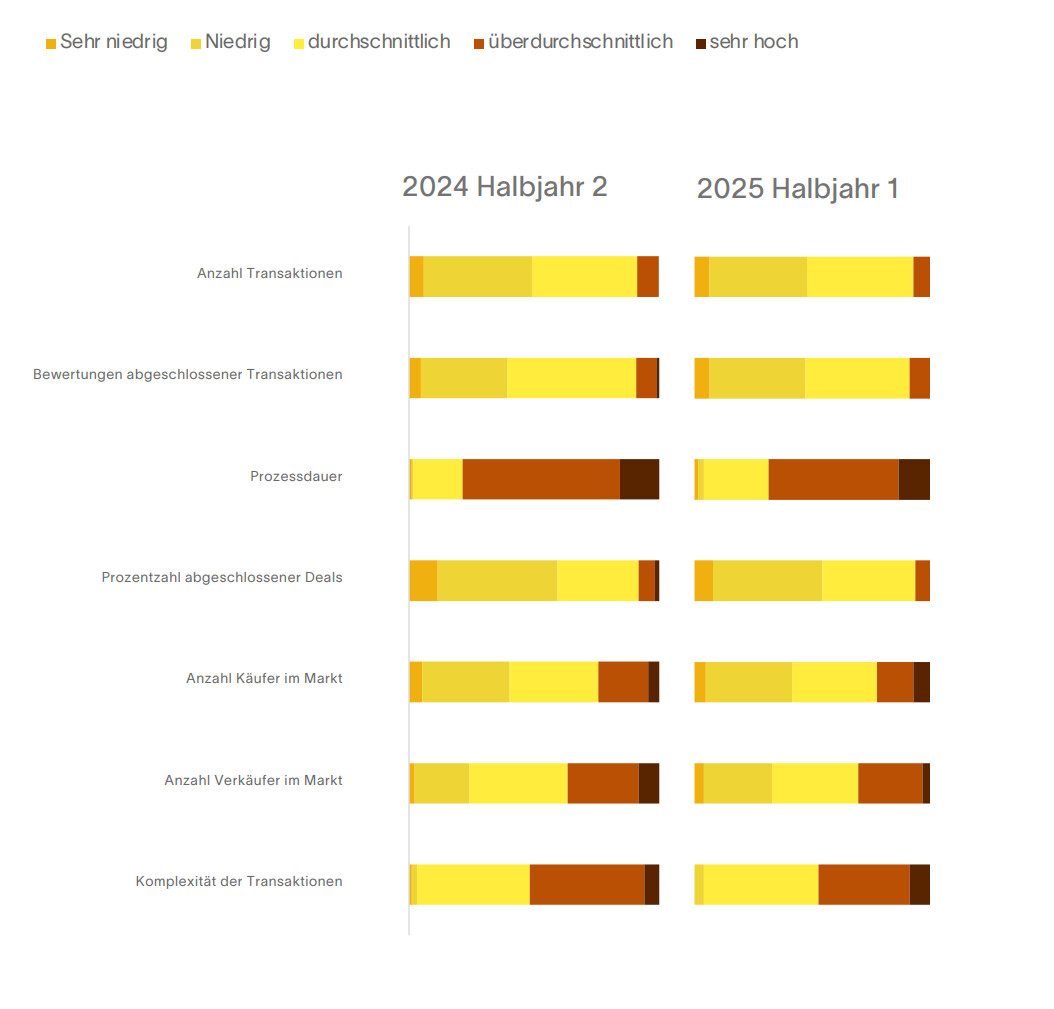

How do you assess the following points in the M&A market in the first half of 2025?

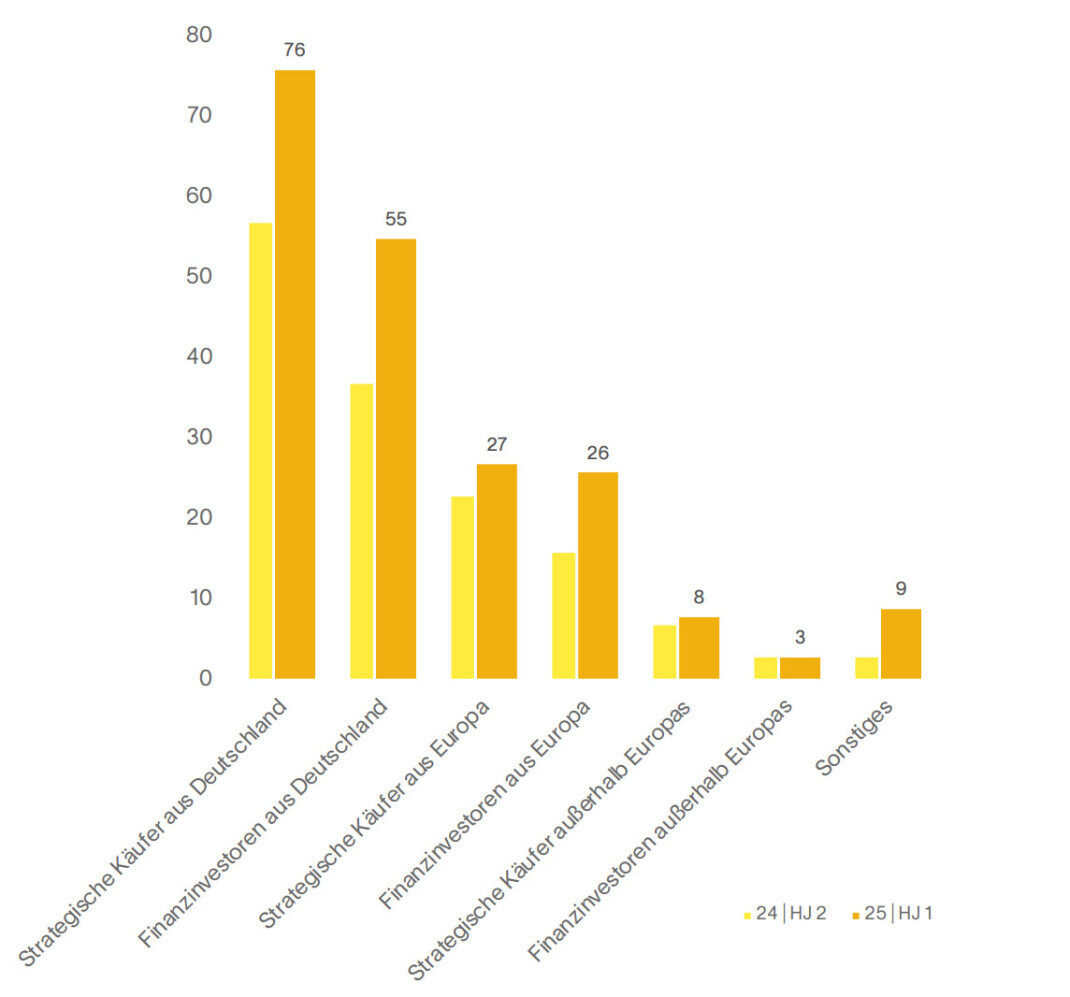

Strategic buyers are currently the most active group. Private equity firms are cautious, as many investments have been in their portfolios for years. According to Dealcircle, around 500 investments in Germany have been in the portfolio for more than five years. Strategists are taking advantage of the situation to make targeted acquisitions, while financial investors are focusing on add-on acquisitions.

“Private equity is sitting on 500 investments that should actually be sold.” Kai Hesselmann, Dealcircle

Financing remains a bottleneck: Despite slightly declining interest rates, the financing situation is showing little improvement. Three-quarters of respondents see no relief. Banks generally only finance up to 3.5 to 4 times EBITDA, and private debt providers are gaining in importance but remain more expensive. Respondents do not expect a sustained recovery in this sector until 2026.

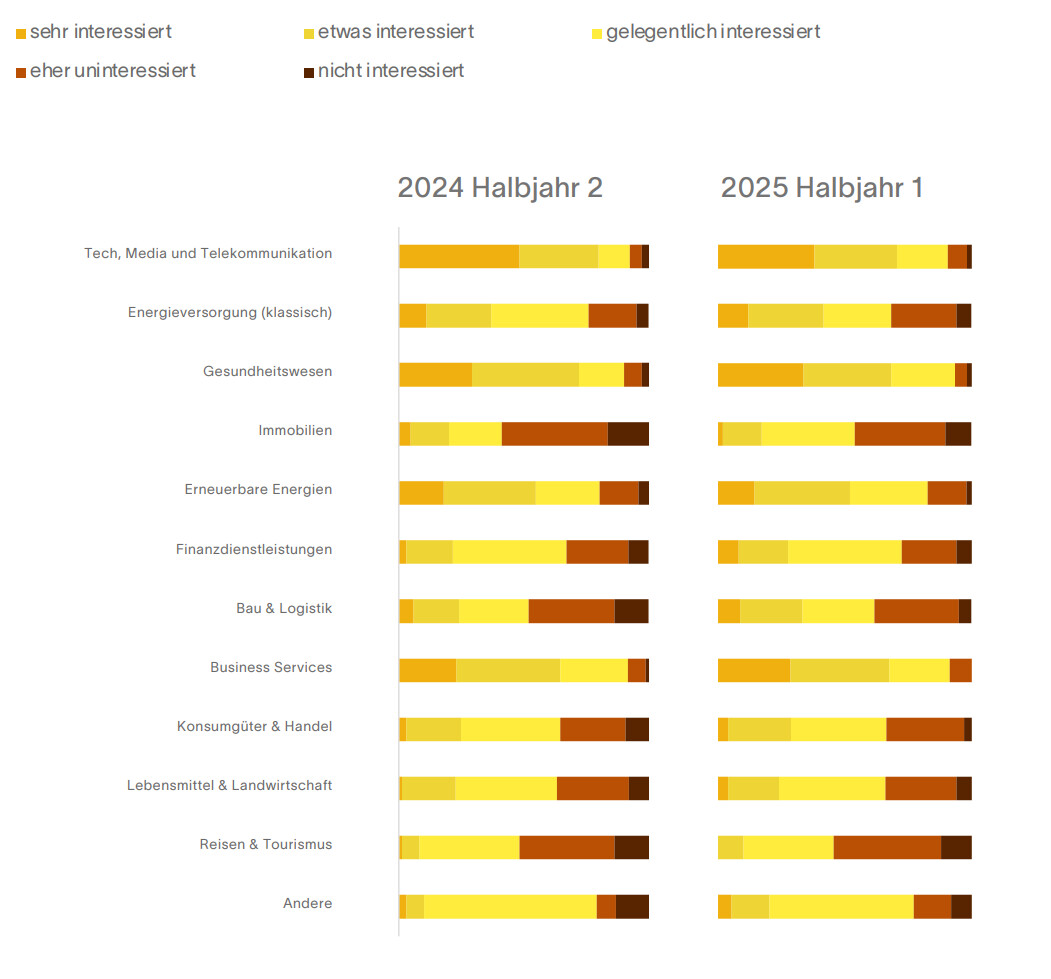

Buyers are focusing on technology, healthcare, energy, and business services. Cyclical sectors such as construction, logistics, and automotive are declining in relevance. Digital business models, sustainability, and automation are seen as anchors of stability—not as growth fantasies.

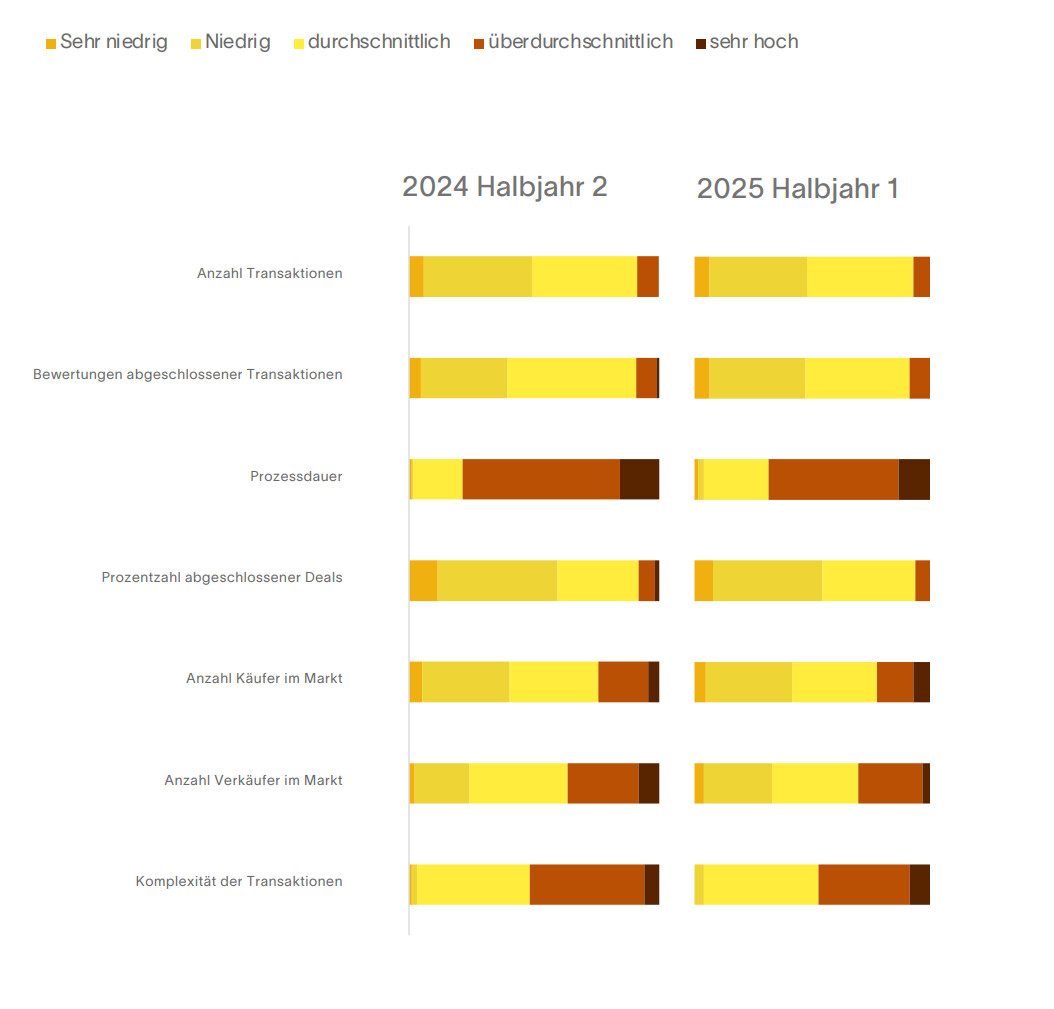

How do you assess the following points in the M&A market in the first half of 2025?

38 percent of respondents cite trade and tariff conflicts as a burden, while 28 percent see financing conditions as the biggest problem. Issues such as AI and ESG play a minor role. The majority rate the federal government's influence on the economy as limited. Their main demands on policymakers are reducing bureaucracy, digitization, and tax relief.

Which factors most frequently led to transaction cancellations in the first half of 2025 – and which factors will be relevant in the next 12 months?

According to Dealcircle experts, 2025 will continue to be a year of consolidation and preparation. Sellers are professionalizing their documents, and buyers are strategically reorienting themselves. Market participants expect significantly higher activity in 2026 – driven by falling interest rates, rising valuations, and growing exit pressure from private equity firms.

private-banking-magazin