Nel: Mixed numbers – share rises sharply

The Norwegian hydrogen specialist Nel has presented mixed figures for the fourth quarter and fiscal year 2024. Nevertheless, the stock, which had previously come under heavy pressure, is rising significantly and is also a popular target for short sellers. The hydrogen stock is up almost ten percent.

Nel recorded a decline in sales of eight percent to 450 million Norwegian kroner (38.5 million euros) in the fourth quarter. Analysts had expected slightly more at 457 million kroner. The electrolysis specialist recorded an EBITDA loss of 36 million kroner (estimate: EBITDA loss of 54 million kroner). The basis for this was a higher than expected gross margin of 65 percent.

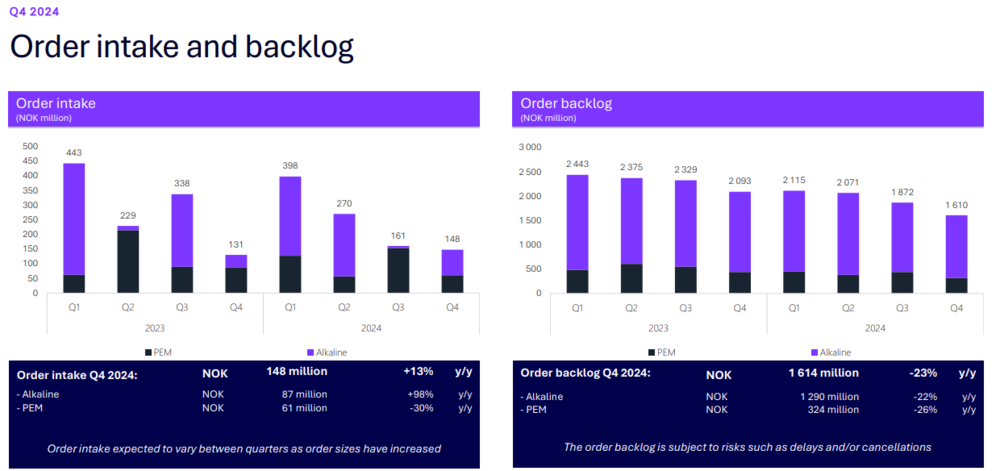

There is also a silver lining in the order intake: compared to the same period last year, this rose by 13 percent to 148 million krone. Admittedly, this was a very low comparison basis. The order backlog, however, fell by 23 percent to 1.61 billion krone (137.8 million euros).

Nel plans to process and deliver 600 million krone of the order backlog this year. However, the Norwegians also admit that there is a "significant risk of delay or cancellation" for orders worth 653 million krone.

At the end of 2024, Nel reported liquid assets of 1.88 billion krone (just over 160 million euros). The Scandinavians have already taken numerous cost-cutting measures in recent months.

The price increase of around ten percent after the figures were not as weak as feared is barely visible in the chart. For a sustainable turnaround, the hydrogen market in general must improve, in which Nel can then score points with its electrolysis solutions. At the moment, there is clearly a lack of impetus and buying arguments for the speculative hydrogen play.

"Winning the Loser's Game" goes back to a magazine article for which Charles D. Ellis received the prestigious Graham & Dodd Award. In it, the author made a pioneering case for a strategy of diversified, low-cost investing in index funds, which he expanded on in his book. The classic is now in its eighth, updated edition and is therefore up to date. New additions include chapters on how technology and big data are challenging traditional investment decisions and how investor behavior influences returns. In addition, new research is presented that supports Ellis' approach and a warning is issued against investing in bonds. A comprehensive guide to long-term investing, successfully updated to reflect the realities of today's markets.

deraktionaer.de