Interview: 'The mining sector can't stand one more tax': Juan Camilo Nariño, president of the Colombian Mining Association

Despite the economy growing at a rate of 2.1 percent in the second quarter of 2025, the mining and quarrying industry plummeted 10.2 percent amid higher tax burdens on the sector. In an interview with EL TIEMPO, Juan Camilo Nariño, president of the Colombian Mining Association (ACM), spoke about the uncertainty facing the industry, a topic that will be discussed at the association's annual congress in Cartagena on August 28 and 29.

President of the ACM, Juan Camilo Nariño. Photo: ACM

It is the result of three years of enormous public outcry and the implementation of the most comprehensive regulatory package of any government in the country's recent history. Taxes, such as the recent one on the first sale and export of coal, have generated profound uncertainty in the mining sector.

Aside from the high tax burden, what else is impacting the mining GDP? There have been a large number of decrees and resolutions that have also affected the certainty of mining investment. The reduction in GDP and foreign direct investment, which is almost 56 percent, is the result of three years of this discussion, which only fails to take into account the communities and the economic drive of many regions, which are the most affected.

There have also been lower prices, particularly for coal, and we need a clear competitiveness policy, and we need to make a decision about whether we want to be a mining country or not, and act accordingly . We'll discuss all of this at the congress.

Are foreign companies being scared away? Without a doubt. Today, countries like Japan, the United States, Norway, Canada, and Australia, among others, are implementing public policies to attract investment in mineral exploration, research, and production. However, Colombian public policies are going in the opposite direction, creating uncertainty for investment and scaring away businesses. I believe we are the ones who are wrong, not the world.

A few weeks ago, it was reported that coal banned by President Gustavo Petro was still being exported to Israel. What do you have to say about this? Yes, it has been exported, as the decree the president himself signed allowed. It's a lie that a group of officials played a dirty trick on him because he himself signed it. Furthermore, there is still no decree that doesn't include clauses enforcing existing long-term contracts, I believe, because that would have significant economic consequences for the State and significant responsibilities for whoever signs them. Therefore, we are waiting.

How has the industry been impacted by the drop in shipments? While Israel continues to purchase all of its tons of coal annually to generate energy for critical infrastructure, such as hospitals, schools, and universities, which also goes to Gaza, Colombia has reduced its trade with Israel by 50 percent, which has had an impact.

Coal exports. Photo: iStock

I call for financial responsibility. This isn't the government's money, but the money of all Colombians. The government must be responsible with its public spending, which is overflowing, with almost 60 percent more contractors outside the state payroll. Furthermore, it must be responsible with the economic future of the various sectors. The private sector, and mining in particular, cannot stand one more tax, especially when it slows down growth and is directed toward unnecessary expenditures.

How has the increase in the withholding tax rate affected you in 2025? This is extremely serious. Not only the mining sector, which was subject to a tax withholding that was more than doubled, but the entire Colombian productive sector. This situation is severely affecting companies' cash flow. It's truly unfair; it's like anticipating a tax reform via decree. Furthermore, it's a huge act of irresponsibility on the part of the government.

The discontent is not limited to large companies, as a few weeks ago there was a miners' strike in Boyacá... At the beginning of this administration, it was said that these amounts of credit were for large-scale mining, which shouldn't be operating in the country. But these strikes and these talks demonstrate that public mining policies are affecting everyone. More than 90 percent of all mining titles in the country belong to small-scale miners . A policy consistent with the needs of many families and the country is needed.

How much do royalties leave per year? This government has received royalties from the mining industry like no other in recent history. Between 2010 and 2020, the total income tax and royalties amounted to around 37 billion pesos, and between 2022 and 2023 alone, it reached 35 billion pesos.

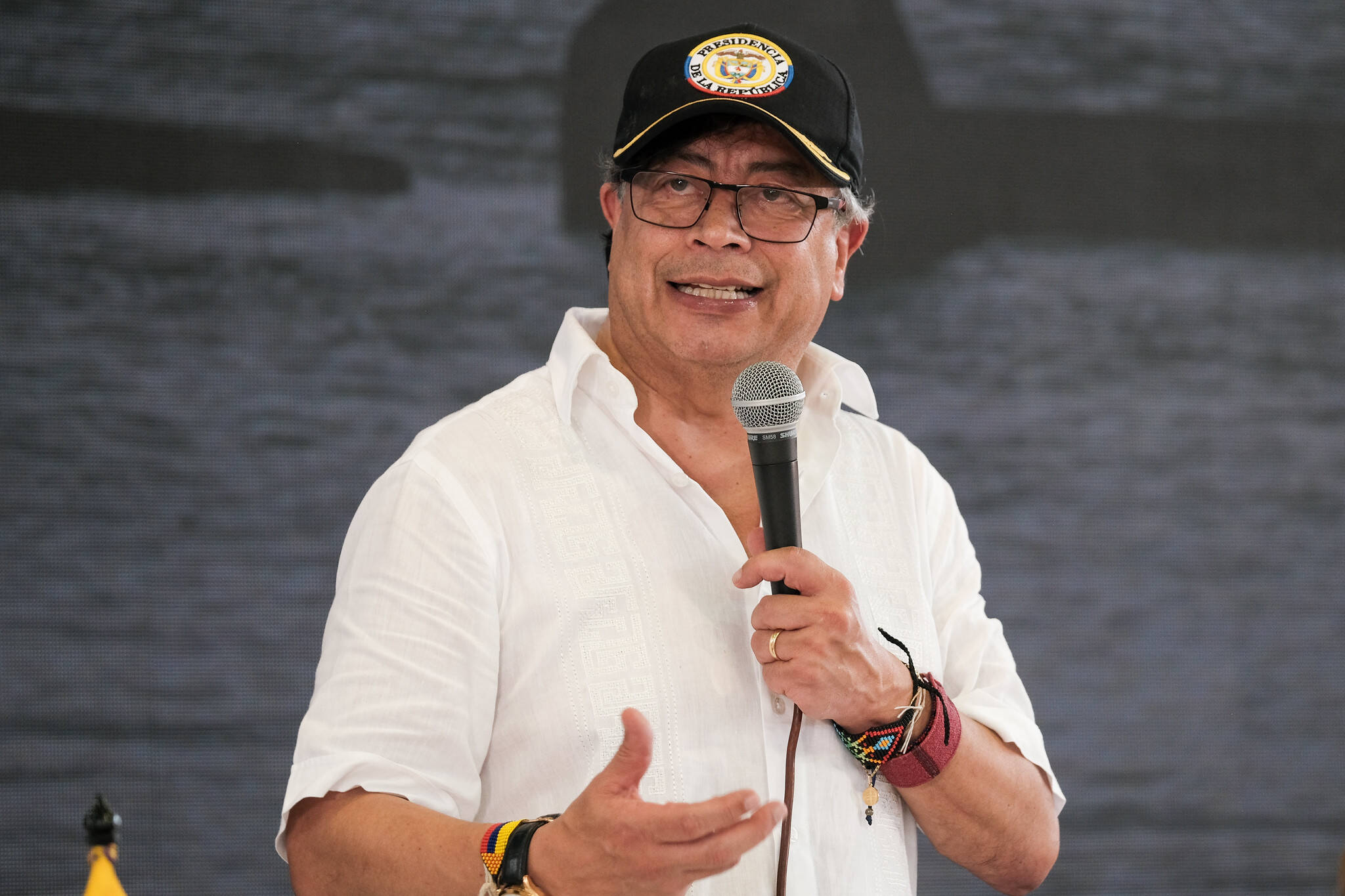

Gustavo Petro, President of Colombia. Photo: Presidency

Colombia has enormous potential for minerals. Today, 97 percent of the territory is untitled , meaning we don't know how many we have. Meanwhile, the world revolves around the need for more minerals to reduce emissions and move toward wind, solar, and electric mobility generation.

In Colombia, we have enormous potential in copper, possibly also in rare earths, and a large number of minerals necessary for a greener world. The invitation is to, as others are doing, generate clear policies and a public conversation, because otherwise, we won't know what minerals we have, and it would be irresponsible to ourselves, to future generations, and to the environmental conversation the world is having today.

How can we move increasingly towards responsible mining? If the world needs more minerals, does that mean mining can be done anywhere in Colombia, and in any way? My answer is no . This is the only sector that has adhered to global mineral production standards, and we have protocols for water management, biodiversity, climate change, and community issues, among others.

At the opening of Congress, the President stated that coal extraction in Colombia has been declining because the world isn't buying this fuel, and therefore the economy can't continue to rely on it. Is this true? That's not true. The International Energy Agency said that by 2024, global coal consumption and demand had reached a historic record. Never before has humanity demanded so much. And by 2025, it forecasts that this record will be surpassed again. Furthermore, between now and 2030, global demand is expected to grow by around 100 million tons. It's not true that the growth in domestic coal production is a result of that. What is true is that coal production is declining, and Colombians have to make a decision moving forward regarding these resources and the possibility of maintaining the industry. Now, our coal markets are no longer in Europe, but in Asia. Therefore, we must be more competitive. When prices fall, it's necessary to have clear public policies as a country to be more competitive in a product that has stabilized public finances for many years and should continue to do so going forward, but it needs to be surrounded by competitiveness policies.

Juan Camilo Nariño, president of the ACM Photo: ACM

Until the world buys it, which will take many years. With these resources, a true social, labor, and economic transition is needed. Furthermore, we must adapt our populations and communities to the real effects of climate change , which will be experienced with greater droughts and longer periods of rain.

What do you consider to be the most important challenges at the moment and what will you discuss in Congress? It's the sudden change in the rules of the game, without consultation with the sector, that generates enormous uncertainty and instability. In Congress, we will debate the future of mining. We must orient our efforts toward what lies ahead, as this is a sector with enormous potential to contribute to public finances and communities through further exploration, by advancing existing copper projects, and through the production of minerals such as coal, nickel, and gold. There are opportunities ahead.

eltiempo