Alternative for providers: How asset managers can position themselves digitally

The digital wealth management sector is teeming with providers vying for investors' favor with promising slogans. From "investing at family office level" to "the most human robo-manager of all," platforms promise customized solutions for private investors. But how do these offerings actually differ from one another, and how do providers manage to stand out from the competition in a highly competitive market? This requires a look at the current market situation and the most important criteria and unique selling points of 20 digital wealth managers.

Product strategies online asset management

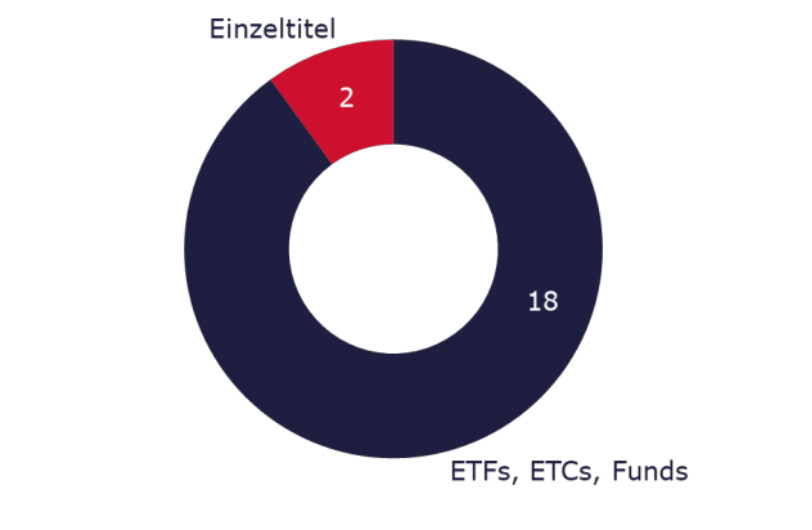

The analysis of 20 online asset managers shows that the majority of providers rely on ETFs and ETCs. 18 of the 20 asset managers examined invest primarily in these two financial instruments, with some also integrating actively managed funds into their portfolios. Only two providers focus on single-security investments, a rare strategy in digital asset management that nevertheless holds its own in price competition.

Breakdown of average costs

If we also consider the average product costs, the total costs for the cheapest provider are 0.56 percent per annum. The most expensive offer is 1.48 percent per annum. This price range shows that while there are no extreme outliers, there are still significant price differences.

Total cost comparison of online asset managers

However, investors are not only looking for the cheapest provider, but also for additional benefits that offer real added value.

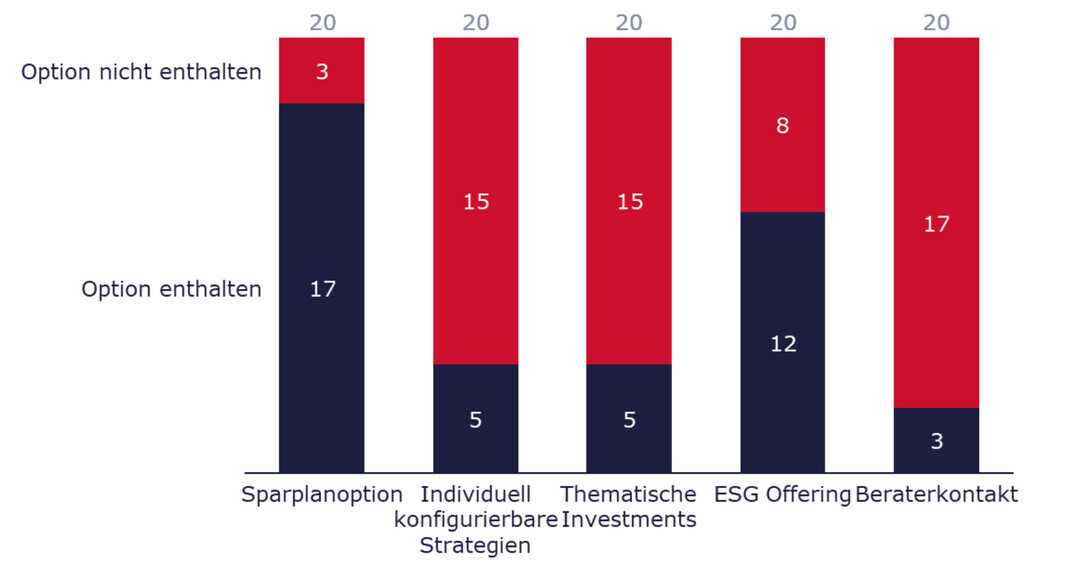

Savings plans, configurable strategies, and thematic investments are some of the factors that differentiate online wealth managers from one another. 17 of the 20 providers allow their clients to invest through savings plans. Only five allow their clients to individually configure their strategy. Regarding thematic investments and special investment strategies, there are various approaches that focus on future trends, specific sectors, technologies, or regional markets.

Furthermore, it's rare for customers to be able to speak directly with advisors. Only three providers offer a personal contact option with advisors.

Distinguishing features according to offer

Given this multitude of similar offerings, the question arises as to how asset managers can position themselves in such a densely competitive environment. If you take a look at "offline asset managers" and the possible options these asset managers offer, you'll find things like strategies that target a certain return, customized strategies that explicitly address client needs, and even single-security-based strategies.

How online wealth managers can stand out from the crowdWhile some platforms attempt to attract customers through price or single-stock investments, it's becoming increasingly clear that these differentiation approaches are often insufficient. In a market characterized by efficiency and automation, providers must dig deeper to achieve long-term success.

While price leadership is tempting, it's not a sustainable long-term path to differentiation. Most digital asset managers operate within a narrow price range, making drastic price advantages virtually impossible. Furthermore, price is not the sole decision-making criterion for many investors. Single-stock investment strategies also offer only limited potential for differentiation.

While these strategies may attract interest from certain investor groups, selecting individual stocks requires a higher level of risk tolerance and is often associated with more effort and uncertainty—both aspects that digital asset managers actually aim to minimize.

Opportunities for differentiation in online asset managementA promising approach to differentiation lies in expanding thematic investments. Instead of focusing exclusively on traditional asset classes, asset managers could offer special thematic funds or portfolios that focus on future trends, specific industries, technologies, or regional markets.

Whether it's megatrends like artificial intelligence, renewable energy, or the healthcare sector, thematic investments offer investors the opportunity to direct their capital into areas they believe in or are particularly interested in.

Ethical investments that emphasize specific values such as social justice, environmental protection, or corporate responsibility are also gaining importance. These investment options are less strictly limited to ESG criteria and allow investors more room for personal priorities. Such tailored portfolios particularly appeal to investors who want to incorporate substantive convictions into their investment decisions in addition to returns.

Another differentiating factor for investors is the ability to individually configure their investment strategy. This approach is primarily common in offline asset management to ensure maximum individuality for clients. By manually adjusting the individual asset classes and weightings within the strategies, asset managers and their clients can offer the individuality of offline asset management online as well.

Hybrid models open doors to new customer groupsWhile this flexibility offers advantages in the form of customized solutions, it also carries risks. Too much freedom can overwhelm inexperienced investors, while too little flexibility can be perceived as inflexible. Therefore, advisors must provide support when it comes to complex and diverse customization options. Advisors could, for example, help with a hybrid approach.

Hybrid models make it possible to integrate elements of traditional, personal wealth management into the digital world. Personal consultations, exclusive analyses, and customized financial plans are services that originate from traditional wealth management and are still valued by many investors.

Digital asset managers that offer such additional services as hybrid models or premium services, and thus additional bookable options, can clearly differentiate themselves from purely automated platforms. Direct contact with an advisor or the opportunity to receive support with complex decisions builds trust and retains clients in the long term.

Other services that could retain customers include exclusive services such as interest on the cash portion through savings accounts, linked credit cards with cashbacks as investments, or even discounts on travel and events. These additional offerings could be particularly aimed at wealthier customers who are looking for more than just a simple digital investment solution.

Combined with the flexibility and automation of digital asset management, such packages can give providers a significant competitive advantage.

The outlook for digital wealth managementIn digital asset management, it's no longer enough to differentiate yourself solely through pricing strategies or single-stock investments. Individualized thematic and ethical investments that address specific investor interests are becoming increasingly important. Greater flexibility in configuring investment strategies and the integration of additional services derived from traditional asset management offer great potential for standing out from the crowd.

Successful providers will be those who not only offer cost-effective and automated solutions, but also create real added value through exclusive services and innovative investment opportunities.

About the author:

Laura Paul is a project manager at the consulting firm Consileon, where she supports clients in the wealth management sector. Her consulting focus is on the selection and implementation of platform solutions in the securities business.

private-banking-magazin