Government bonds and swaps: shift in market mechanisms

Risks are an inevitable part of the financial markets. Our human psyche is designed to identify and avoid dangers—an evolutionary protective function. However, in the financial markets, an excessive focus on risks can lead to missed opportunities. Therefore, it is crucial to evaluate risks rationally rather than being driven by fear. Herd instinct often significantly influences investor behavior: rapid, impulsive reactions to news, while an objective assessment of the long-term consequences takes a back seat.

A holistic view of risks helps distinguish between assessable threats and unpredictable "black swan events." Furthermore, risks are not isolated events; they arise from the interaction of political, economic, and social factors. And although uncertainties shape markets, history shows that economic and financial systems have weathered crises and continuously adapted.

Geopolitical tensions & security risksSeveral geopolitical conflicts are currently influencing global events: the war in Ukraine, tensions surrounding Taiwan, disputes in the Middle East, and escalating trade conflicts. There are more than 65 active conflicts worldwide, further increasing uncertainty in the markets. However, it is proving ineffective for investors to make blanket assessments of geopolitical actors or classify them into simplified categories. Rather, it is crucial to analyze the specific economic impacts of these conflicts and understand their long-term consequences.

Wars typically have a strong short-term impact on financial markets. A prominent example of this was the outbreak of the Russia-Ukraine war in 2022, which led to a significant correction in global stock markets. However, after risks have been priced in and changes in economic conditions have been made, geopolitical conflicts often fade into the background of market considerations. Historically, this is particularly evident in the example of World War II, when stock markets experienced significant upward movements during and after the war.

Nevertheless, not all geopolitical tensions are equal. Trade wars, such as the ongoing economic conflict between the US and China, have deeper structural effects than military conflicts. While traditional wars cause temporary disruption, tariffs, sanctions, and deglobalization have a long-term impact on the global economic environment.

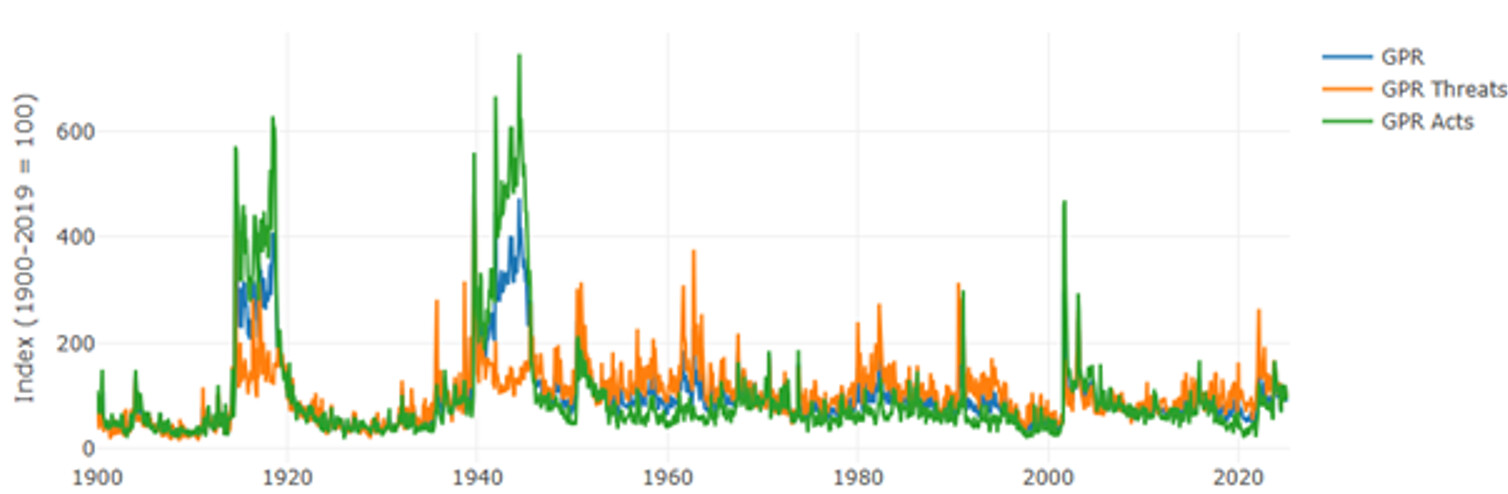

Historically, there have been significantly more extreme periods based on the Geopolitical Risk Index:

Rising government debt and persistently high budget deficits pose a serious strain on economic stability. While many governments are taking on new debt to address short-term economic challenges, higher interest rates are significantly increasing long-term financing costs. Highly indebted countries, in particular, are coming under increasing pressure as they are forced to either implement drastic austerity measures or further expand their deficits, both of which have negative consequences for investor confidence.

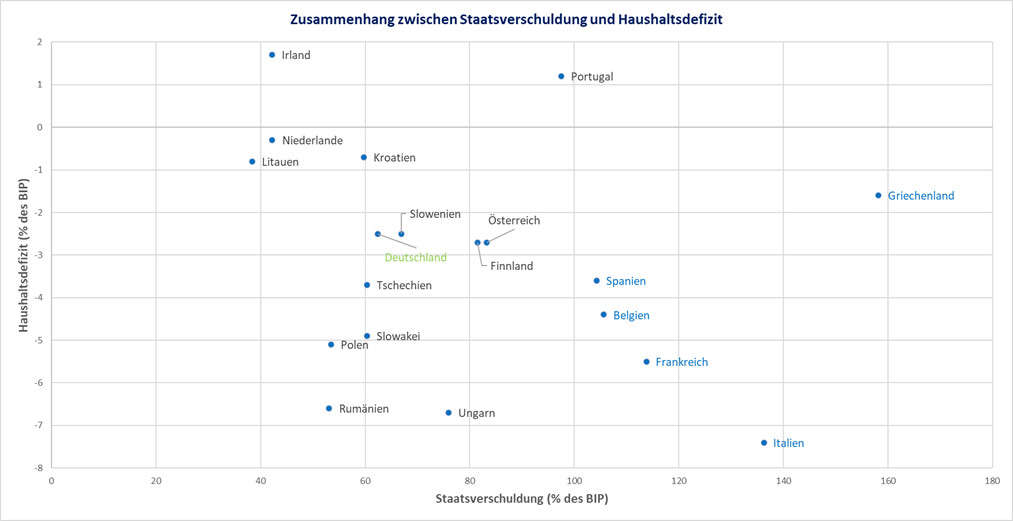

In the Eurozone, the economic gap between more stable countries and highly indebted states is widening, reflected in rising risk premiums for government bonds. Countries with sound finances continue to receive loans on favorable terms, while countries with high levels of debt must pay noticeably higher interest rates.

The following graph shows a comparison of some euro area countries in terms of their debt ratios and budget deficits.

A similar picture emerges outside of Europe: Japan has the highest national debt at 251 percent of GDP, while the United States, with 121 percent of GDP and a budget deficit of minus 7.6 percent, also faces major fiscal challenges. These enormous debt levels raise long-term questions about the sustainability of economic policy, especially if interest rates continue to rise and refinancing costs increase.

In addition, the planned expansion of defense spending increases debt pressure. To achieve NATO's target of 3.5 percent of GDP for defense spending, countries like Germany, France, and Italy will have to massively expand their budgets. This will inevitably lead to a rising debt ratio and growing deficits. At the same time, the idea of a European debt mutualization is gaining momentum, even though the northern eurozone countries have so far been able to fend it off.

In addition, the German government approved the largest debt-financed infrastructure program ever, worth €500 billion. Although this is likely to provide a positive stimulus for the economy, it also exacerbates the debt problem. However, these issues do not represent short-term risks, but will have a lasting and long-term impact on government debt.

Germany's rising national debt can be illuminated not only by current figures and forecasts, but also by looking back at the past. Similar financial pressures arose in 1990, when Germany faced the challenge of integrating the East German economy after reunification. This measure led to a significant expansion of government spending and thus debt.

Despite the enormous burden, Germany was able to successfully manage its debt at the time. However, it is unrealistic to expect that a comparable level of debt would go unnoticed by the capital markets today, as is already evident from the recent rise in yields and the rise in Bund yields above the swap rate. The markets reacted just as quickly to the massive debt at the time. Yields on ten-year Bunds rose rapidly as the market realized that the economic situation had changed dramatically.

A similar picture can be observed today. Germany could still absorb a significant increase in debt without exceeding the debt levels of other European countries. Specifically, an additional borrowing of over €1,600 billion would be possible, an increase somewhat reminiscent of the debt increase in the early 1990s.

Another significant economic risk is the increasing protectionist trade policy. The trade conflict between the US and China, which has been ongoing since 2018, has had a significant impact on global supply chains and production costs through tariff increases and trade restrictions. Export-dependent economies such as Germany and China are particularly affected by rising costs and geopolitical uncertainty. At the same time, this development is driving inflation as higher import costs are passed on to consumers.

Combined with rising tariffs, the likelihood of a recession increases significantly. While there are currently no clear signs of an imminent recession either globally or in the US, this scenario remains a possibility. Europe, on the other hand, has been experiencing a period of economic weakness with minimal growth for two years. This persistent growth slump is weighing on companies and consumers alike and is squeezing profit margins in many sectors.

The US recorded gross domestic product growth of minus 0.3 percent in the first quarter, providing an initial glimpse into the impact of the tariffs introduced. However, short-term imports and inventory buildups helped cushion the economic downturn – in the previous quarter, gross domestic product growth was still around 2.5 percent. Developments in the second quarter, including further decisions on tariff policy and possible agreements between the US and its trading partners, will provide more clarity and clarify the impact on the economy.

Central bank policy & financial market risksHistorically, almost every recession has been preceded by a yield curve inversion. This occurs when yields on short-term bonds are higher than on long-term bonds—a clear signal of an economic slowdown. In the past, recessions usually followed a period of yield curve steepening, which occurs when short-term interest rates fall again while long-term interest rates remain high or continue to rise.

Since the end of 2022, an inverted yield curve has been observed, which is now being resolved by falling short-term interest rates. This is due to declining inflation and central banks responding to the economic slowdown with interest rate cuts. At the same time, long-term interest rates continue to rise as growing government debt affects demand for long-term government bonds and investors demand higher yields.

A particularly notable phenomenon in the financial market is the current negative Bund/swap spread, which is historically extremely rare. German Bunds are typically considered the safest haven in the European capital market and therefore generally yield lower returns than the corresponding swap rates. However, the current negative spread means that investors view swaps as safer than Bunds—a clear shift in market mechanisms.

- First, expectations of a significant increase in future government debt in Germany and Europe weakened confidence in German government bonds. While demand for safe and liquid investments remains high, the enormous supply of bonds is leading to an oversupply, driving up yields.

- Second, the withdrawal of the European Central Bank is reinforcing this effect: While it used to act as a reliable buyer, it is now reducing its balance sheet, further reducing demand for German government bonds.

- Third, the changed liquidity situation ensures that swap markets are perceived as more flexible and less affected by excess supply, which further increases their attractiveness.

The implications of this development are far-reaching: A negative Bund/swap spread could further increase Germany's financing costs as investors demand higher risk premiums. This also has implications for other European countries, as their bond spreads could widen relative to Germany. For banks and institutional investors that traditionally use Bunds as collateral, this represents a new uncertainty that could have long-term implications for lending and market stability.

This extraordinary market distortion underscores the growing structural challenges in the European financial system. Should confidence in government bonds deteriorate further or government financing costs continue to rise, this could have long-term implications for the stability of the European capital market.

Warren Buffett indicator suggests correction potential on the stock marketIn addition to developments in the bond market, current equity market valuations are also a critical factor. The so-called Warren Buffett Indicator, which compares total US market capitalization to US GDP, recently exceeded 200 percent, a level considered extremely high.

Historically, this indicator has reliably pointed to overvalued markets, most recently before the dot-com bubble burst in 2000, when it peaked at around 150 percent. While this indicator is not an exact timing factor, it signals that stock markets could have significant correction potential if conditions change.

Another key point is the dominant role of the US market. Given the global importance of the US, anyone with equity exposure should focus more on American indices such as the S&P 500 and less on the DAX. The DAX, although widely followed in Europe, is comparatively insignificant in terms of global weighting. Furthermore, the US indices are heavily reliant on a few heavyweights, the so-called "Magnificent 7," which account for over 30 percent of total market capitalization and thus significantly influence price performance.

Historically, this high concentration represented a risk factor that disappeared when, in correction phases, such as the dot-com bubble or the Nifty Fifty era, hyped companies fell more sharply than the overall market, thus reassessing their disproportionate weighting.

A look at the 200-day moving average also plays an important role in this context. This line is a widely followed indicator of long-term uptrends and downtrends. If an index price sustainably falls below the 200-day moving average, many analysts interpret this as a signal of a trend reversal or at least an impending correction. The S&P 500 fell below the 200-day moving average in Q1 2025.

Should macroeconomic conditions deteriorate, for example due to renewed inflationary pressures, more restrictive monetary policy, or weaker corporate earnings, the currently high valuations could be unsustainable and trigger major market setbacks. The US stock market experienced a correction in early 2025, particularly due to the tariffs introduced by the US and its intensified countermeasures.

The real estate market has also felt the effects of rising interest rates over the past two years. Rapidly rising financing costs led to a noticeable price correction, and market euphoria subsided. Commercial real estate and high-priced residential properties, in particular, recorded declines, as many investors remained cautious in the face of rising interest rates. Nevertheless, initial signs of stabilization are emerging. A key factor is the continued rise in rents, which is evident despite declining purchase prices, particularly in large cities, where rents are rising rapidly and increasing the long-term attractiveness of real estate investments. Furthermore, many investors expect real estate prices to bottom out, as medium-term interest rate cuts are likely to lower financing costs again.

Gold is a stable rock in the surfIn times of global uncertainty, gold is once again proving itself a reliable source of stability. While markets are influenced by volatility, inflation, and geopolitical tensions, many investors see the precious metal as a sensible hedge against potential risks of the fiat monetary system.

Especially at a time when debt levels are exploding worldwide and central bank policies are roiling the financial markets, gold plays a central role as a stable asset. While stocks and real estate are in a correction phase, gold remains a stable rock, protecting the portfolio against market turbulence.

Over the past few years, the price of gold has consistently risen, a solid sign of long-term appreciation. This stability and positive performance make gold an indispensable component of any diversified investment strategy, especially in uncertain times when pressure on other asset classes is increasing.

The ECB's monetary policy also contributes to uncertainty in the capital markets. The ECB has proven to be a key factor of stability in recent years by purchasing bonds on a large scale. However, as these purchases are gradually wound down, demand for government bonds is declining, leading to rising yields and potentially triggering market distortions. Countries with higher levels of debt are particularly hard hit.

In the past, international central banks have repeatedly reacted too late and failed to counter inflation risks early on. The best and most recent example of this is the rampant inflation starting in 2022, which was contained by late but aggressive interest rate hikes. The late but then very tight interest rate hike policy of the world's central banks is likely not without consequences for the economy and increases downstream risks, even if interest rates are now lowered again. The question is how the monetary policy stance might change due to an increased inflation risk due to the imposed tariffs. The US Federal Reserve has halted its interest rate cut cycle for the time being.

Ultimately, the two key factors influencing the financial markets are economic developments and monetary policy. The combination of a weakening economy and a change in monetary policy significantly influences future corporate profits and thus also stock market valuations.

Historical examples such as the 2008 financial crisis or the dot-com crash in the early 2000s demonstrate that the interplay of restrictive monetary policy, a weakening economy, and external shocks can significantly impact markets. Investors should closely monitor these risks and consider risk diversification and hedging strategies.

Social risksSociety faces a multitude of structural challenges that pose long-term economic and social risks. Demographic change with an aging population is putting a strain on pension and social security systems, while high public debt and rising tax burdens are exacerbating political tensions. Unstable governments, populist movements, and failed migration strategies are creating uncertainties that could negatively impact investment and economic growth.

At the same time, technological disruptions such as artificial intelligence and automation threaten millions of jobs, while companies are increasingly offshoring. Natural disasters and climate change are leading to economic losses, while inflation and rising living costs are eroding people's purchasing power. These factors have long-term negative effects on financial markets, as consumer behavior, investment flows, and government policies become increasingly unpredictable.

A particularly pressing structural risk is the increasing burden on pension systems. Federal funding for statutory pension insurance in Germany is expected to rise to €139 billion by 2030, up from €66 billion in 2000. In 2024, pension subsidies will account for approximately €116 billion, representing approximately 25 percent of the total federal budget.

These rising transfer payments place a significant strain on public finances and raise questions about the long-term sustainability of the pension system. Without fundamental reforms, future generations could face even higher tax burdens or benefit cuts, which in turn could negatively impact consumption and economic dynamism.

Unforeseeable risksIn addition to the known risks, unforeseeable shocks can occur at any time, suddenly and leading to dramatic market disruptions. These so-called black swan events are rare, but they have enormous impacts on financial markets and the global economy. Past examples include the 2008 financial crisis and the COVID-19 pandemic. Such events cannot be precisely predicted, but they demonstrate that financial markets can always be influenced in unpredictable ways.

Future unforeseeable events could include an unexpected systemic banking crisis triggered by a loss of confidence or a chain reaction of defaults. Abrupt political decisions, such as a country's sudden withdrawal from a trade union or sanctions against major economies, could also have massive impacts on the markets. Technological disruptions, such as an uncontrolled breakthrough in artificial intelligence or a global cyberattack, also pose difficult-to-predict but highly relevant risks.

Since these events cannot be predicted with conventional forecasting models, robust risk management is essential. Diversification, flexible investment strategies, and continuous market monitoring help investors better respond to such shocks and protect their portfolios against extreme uncertainty.

Conclusion: Dynamic risk management for uncertain timesIn uncertain times, dynamic risk management is essential. The combination of geopolitical tensions, economic uncertainty, and unpredictable shocks requires strategic portfolio adjustment:

- Diversification across different asset classes: This reduces the risk of individual events and protects the portfolio from excessive fluctuations in a particular area.

- Flexibility in investment strategy: This enables you to adapt quickly to changing market conditions and take advantage of potential opportunities arising from unexpected developments.

- Macroeconomic analysis: A sound analysis of the overall economic situation is crucial for identifying risks early and responding to changes in a targeted manner.

- Long-term strategy: An asset allocation and investment strategy aligned with the business model, which also holds up during crises, is essential. It ensures that the portfolio remains resilient, even when markets are subject to strong fluctuations.

Investors should be aware that risk and return are inextricably linked. A balanced approach that considers both hedging and targeted opportunity capture remains the key to long-term success.

About the author: Jonas Köberle has been working for the consulting and investment firm KC Risk since 2020. His focus is on banking treasury and consulting.

private-banking-magazin