Siemens Energy: State guarantees redeemed early – will there be a dividend soon?

Siemens Energy has taken an important step: The company has fully repaid the more than eleven billion euros in federal aid it received in the crisis year of 2023 in the form of counter-guarantees. Instead, a new guarantee agreement for nine billion euros was concluded with a banking consortium of 23 institutions – entirely without government backing.

The technology group urgently needed government support at the time. On the one hand, its wind power division was struggling with significant problems, while on the other, its project business was growing rapidly – coupled with high guarantee requirements. Given the strained situation, it was virtually impossible to obtain sufficient bank guarantees at reasonable terms. The €11 billion government guarantee closed this gap – for an annual fee of approximately €100 million, as CEO Christian Bruch explained to Handelsblatt.

The financial situation has since improved significantly. Siemens Energy is aiming for its second consecutive annual profit. Maria Ferraro, CFO of Siemens Energy, commented on Siemens Energy's approach: "The federal government's counter-guarantee was important in 2023 to secure the expected strong growth during a challenging period. Thanks to our performance over the past two years and an attractive market environment, we have significantly improved our margins and cash flow, as well as further strengthened our balance sheet. Therefore, we were able to redeem the federal government's guarantee before the end of the fiscal year, as planned."

This is also a positive signal for shareholders: With the end of government support, the dividend ban will end – starting with the new fiscal year in October. If the positive trend continues, dividends could flow for the first time in 2027.

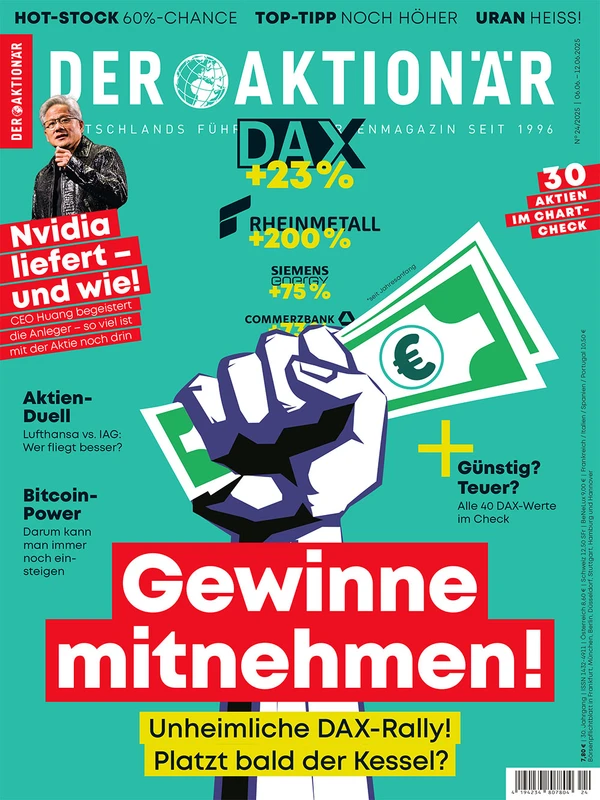

Siemens Energy shares were the strongest performers in the DAX over the past three months, gaining 60 percent, ahead of Rheinmetall and E.on. On Wednesday, the stock reached a new all-time high of €89.52. The outlook remains good. Those on board are letting the profits run.

Statistically speaking, investing in stocks is one of the safest ways to build wealth over the years. So why do so many people still consider the stock market a casino and buying stocks a wild gamble? Stock market expert Andreas Lipkow explains. He shows how you can actually invest successfully on the stock market—but also which methods and strategies either don't work or no longer work. "Successful Strategic Investing" is the perfect book for anyone who wants to acquire the knowledge to successfully grow their money on the stock market.

deraktionaer.de